SUMMARY

-

Recession fears are receding significantly and are 20% lower as a barrier to scientists from the beginning of 2023

-

Key indicators suggest a swell of optimism among scientists and high expectations for scientific progress in the year ahead. More than half (57%) of respondents feel highly confident they will meet their productivity goals in 2023

-

Automation and AI integration are top areas of interest to scientists, and 38% of respondents in biopharma/pharma say adopting ML or AI is a top priority for this year

-

Biopharma is in a process of seeking efficiency and prioritizing their programs and initiatives

This report is a portion of the dataset and information from our State of Science survey. For additional information on particular segments or subsegments please reach out to our team or sign up for a Strategy Sprint session.

Many life science tools and diagnostics companies have experienced a slow-down in sales, driven primarily by the tighter funding for small and emerging pharma and biotech companies, supply hoarding in 2022, and a sense of anxiety about the economy.

While the financial markets and supply chain issues are well-defined moments in time, understanding and influencing the consumer sentiment of the market can bring significant control for supply and service companies and can enable executives to meet and grow their businesses. Our semi-annual State of Science study tracks what scientists around the globe are thinking about for the next six months, quantifying their views about scientific priorities, their budgets, which techniques and technologies they expect to use, the products and services they plan to purchase, and the barriers that may be in the way. Respondents differed greatly when we segmented the data by application areas and other demographic information.

What we are finding in our latest study is that we are in a unique moment in the life science industry — one ripe with opportunities if you know where to look.

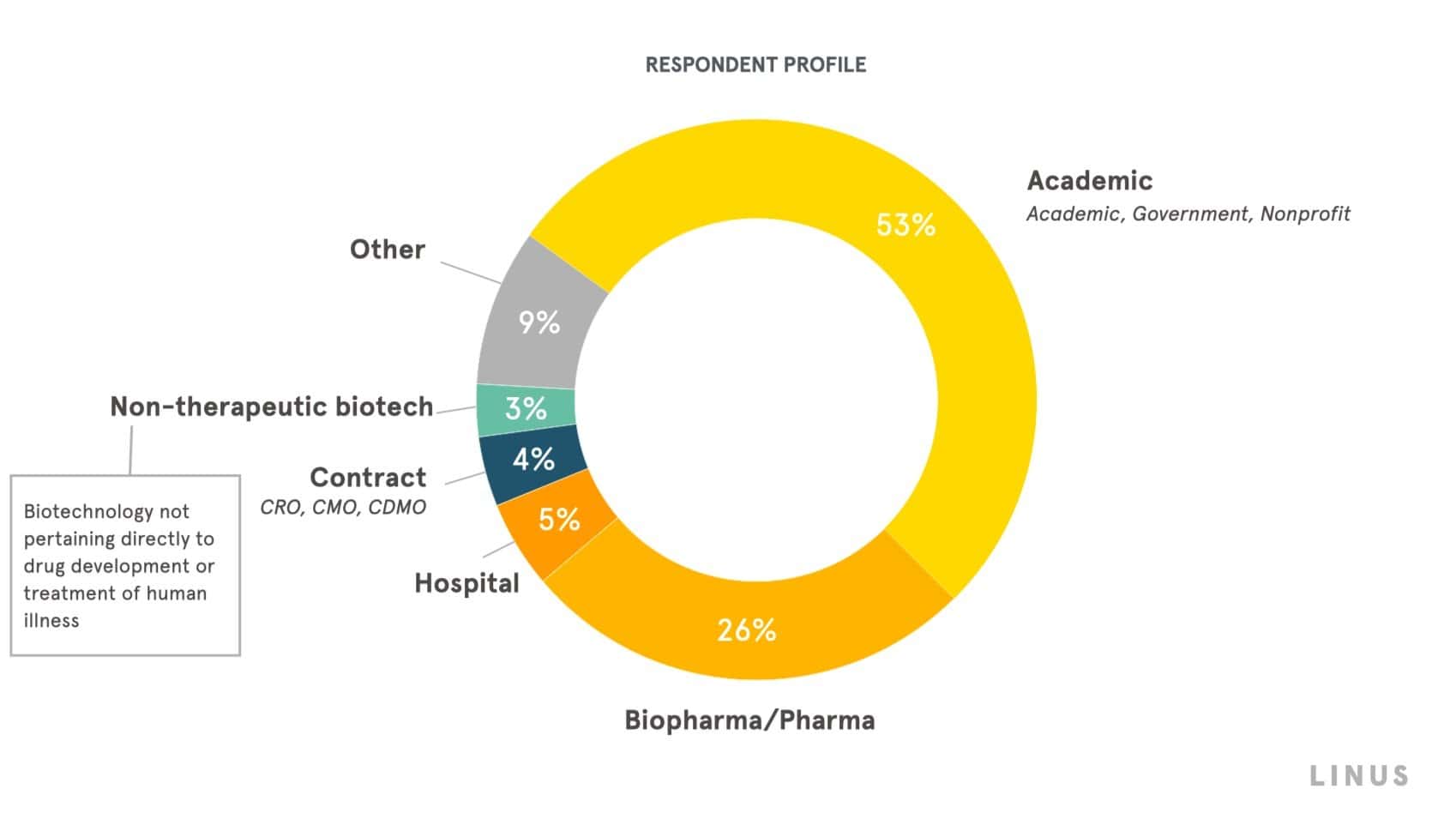

About Our Advisory Respondents

Using our digital research platform, we surveyed 574 scientists representing multiple geographies, organizations, applications, and levels of responsibility. To dig deeper, we enhanced this with one-on-one in-depth interviews with 15 scientists to probe deeper behind some of the key findings. Our goal was to measure how sentiment has changed in the last 6 months, and what changes we may expect to see as 2023 progresses.

This survey is mainly composed of scientists from North America (59%) and Europe (27%), with the remainder working in the rest of the world.

About half (53%) of respondents work in an academic research setting and another 26% of respondents work in pharmaceutical and biopharmaceutical research or development industries. The remaining respondents make up a spectrum of related research and development activities, in services, industrial biotechnology, manufacturing, or clinical applications.

Q: Which of the following best describes the type of organization you work for or are affiliated with? (n=574)

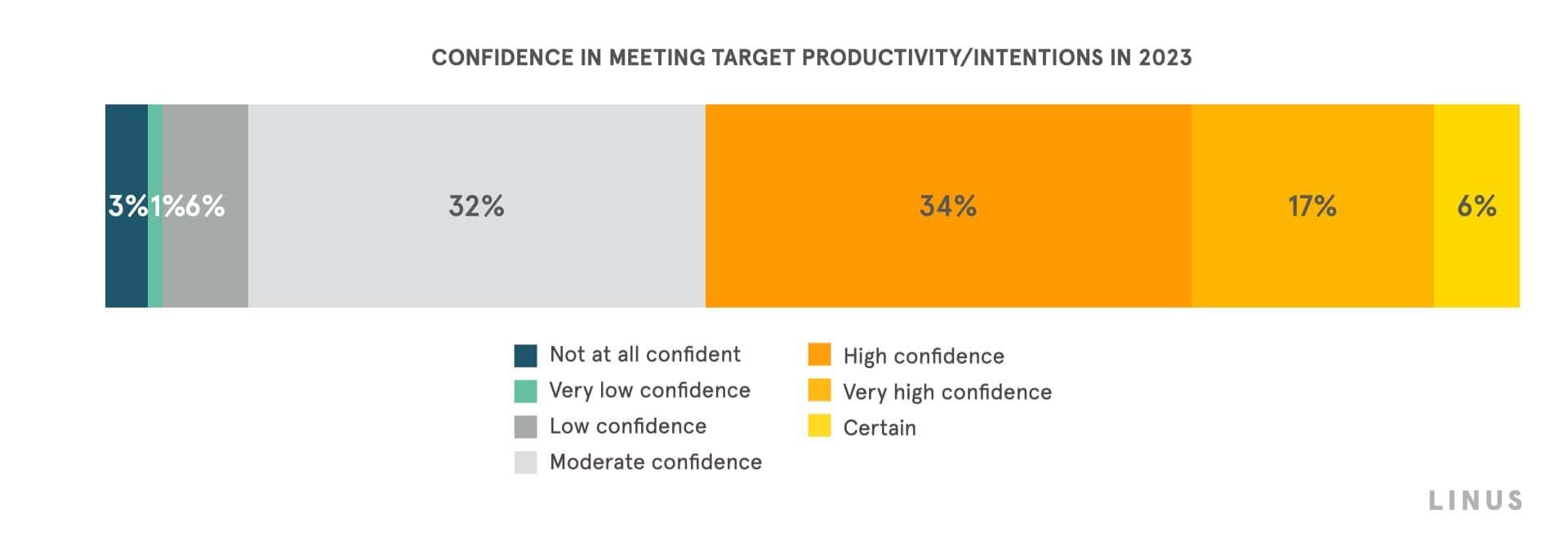

Measuring Productivity and Scientific Priorities

A key indicator of sentiment in science is to measure respondents’ outlook on their productivity. Overall, we found that the outlook for productivity for the rest of 2023 remains optimistic, with 89% of scientists having positive confidence that they will meet their target productivity goals in 2023.

This confidence is largely buoyed by a drive for increased efficiency — specifically in biopharma and pharma segments. One Research DIrector at a biopharma company told us that, “We need to get more focused and more efficient on delivering key datasets. In the next year or two, we’ll be more exponential.”

Q: Overall, on a scale 1-7 with 1 being not at all confident and 7 being certain, how confident do you feel that you will meet your target productivity goals or intentions in 2023? (n=572)

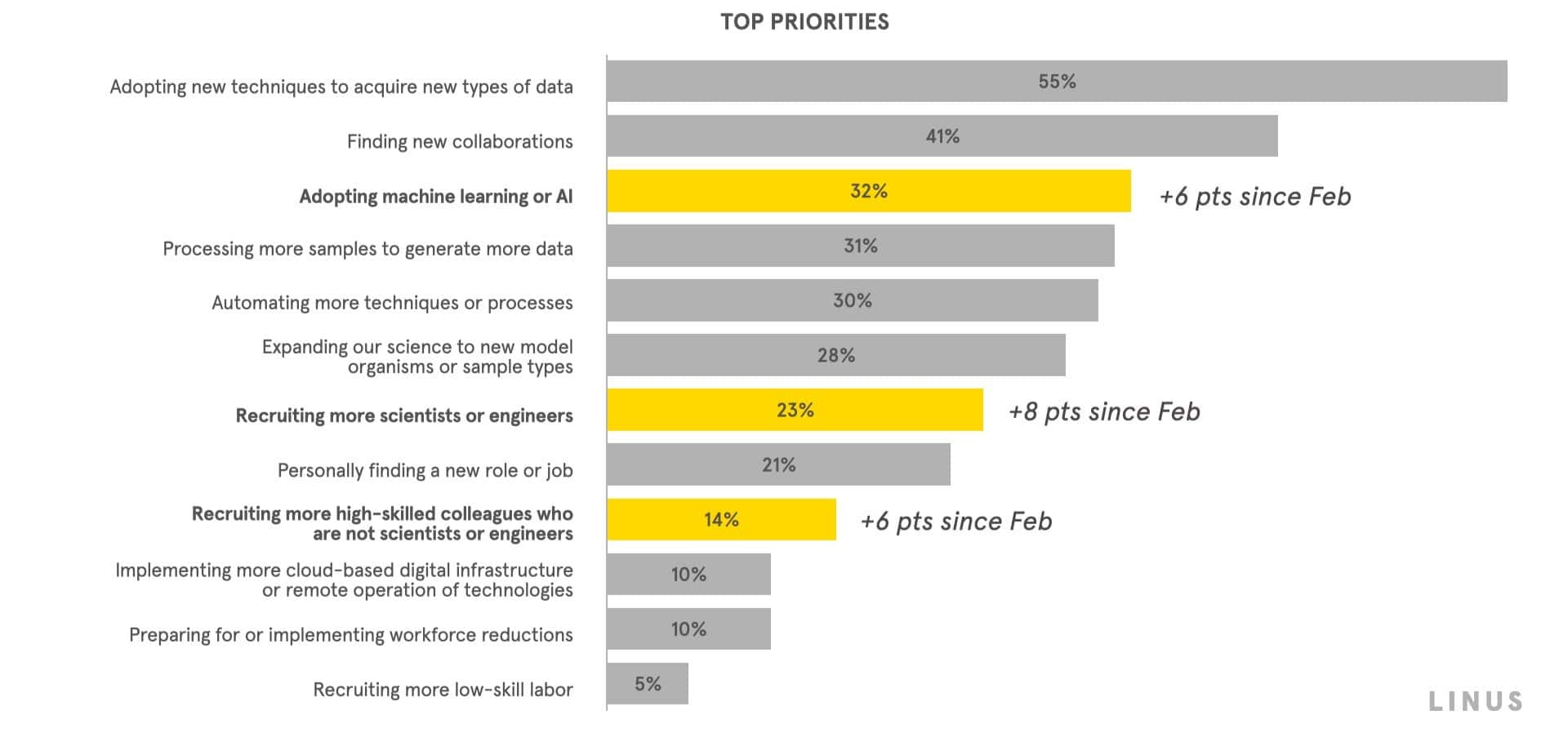

Just as in 2022 and earlier 2023, scientists are most likely to prioritize the adoption of new techniques, collaboration, and automation in the next 6 months.hile foundational research priorities are still top priorities among our respondents, interest in machine learning and AI (32%) and recruiting more engineers or scientists (23%), or high-skilled colleagues (14%) have jumped in relevance compared to earlier this year.

Q: Thinking about your own work in 2023, which of the following are your top 3 priorities? (n=574)

Priorities for the rest of the year vary by the type of organization our respondents work in. Biopharma and pharma industries are uniquely likely to prioritize working smarter to get more from their data they generate: 48% of respondents in biopharma/pharma are adopting new techniques to acquire new types of data; 40% are automating more techniques or processes and 38% are adopting machine learning or AI.

Barriers

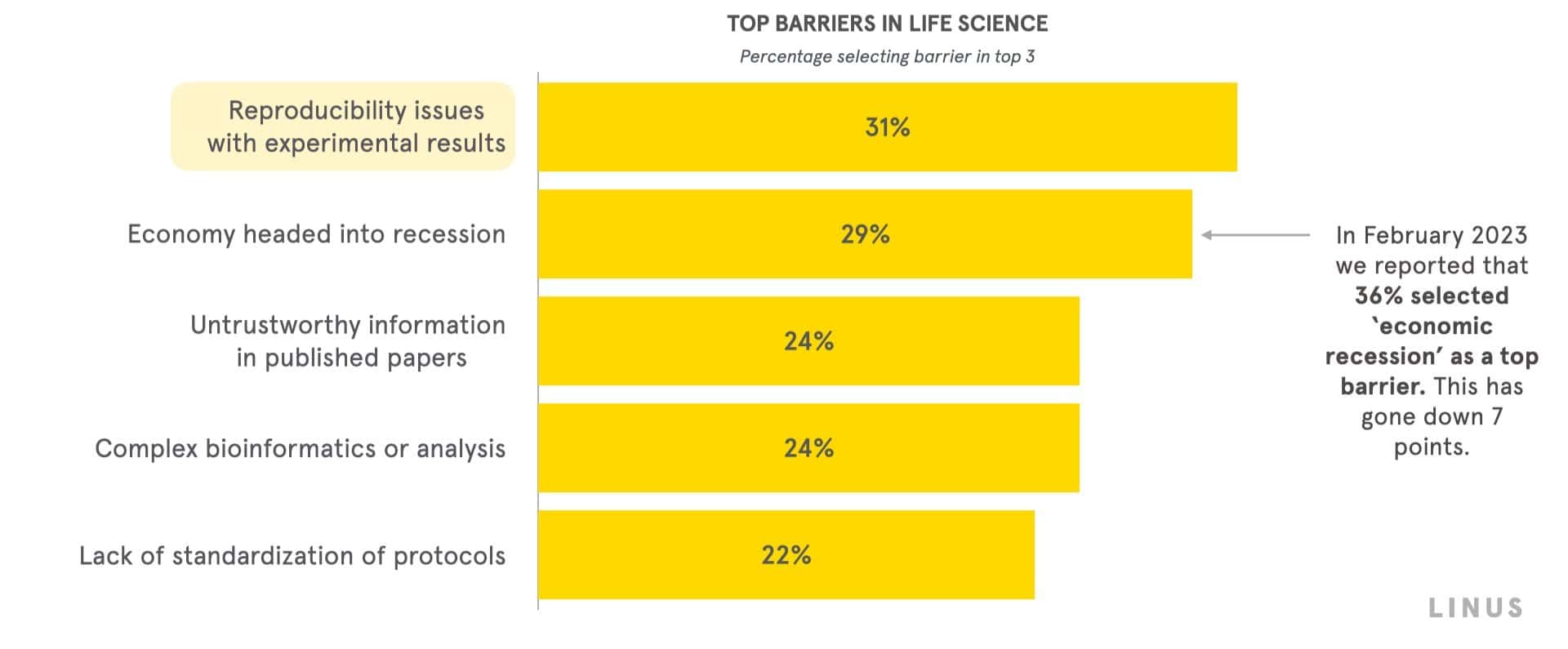

At the beginning of 2023, 36% of respondents selected economic recession as their top barrier in making progress — outranking all other options. In our most recent survey, that number has dropped by 7 points to second place, at 29%.

Q: In your opinion, which of the below are the top 3 barriers in life science today? (n=574)

Reproducibility is once again the top barrier for 1 in 3 scientists surveyed — a trend that is consistent with findings in previous years. And scientists today are open to paying a premium to reduce the variability in their science.

Pharma and Biopharma scientists see reducing reproducibility issues as a key area for gaining efficiency. One scientist articulated the issue by providing an example of when the biopharma company provides the scientific blueprint to a contract organization, and the CRO gets different results, sometimes due to variability in the reagents or consumablesScientists are willing to pay a premium to suppliers who provide better characterizations and more transparency in reagents, materials, and kits. Another scientist said, “100% I would pay extra [for this solution], and I know a lot of people who would. There’s a lot of frustration to figure these [variability] things out.”

Respondents also identified untrustworthy information in published papers, complex bioinformatics or analysis, and a lack of standardization of protocols as their top of mind barriers in life science today.

Technology Purchases

In the second half of 2023, more than half of respondents (53%) still plan to purchase new technology — a drastic change from our findings in mid-2022, when only 32% of scientists stated they intended to purchase new technologies in the remainder of that year. Unlike previous years, AI-related purchases have now joined as the top three technologies in purchase intent, where 1 in 10 plan to make such a purchase, joining Sequencers (14%)and Automated Systems (10%).

Although enthusiasm is high, some Biopharma and Pharma organizations are experiencing limitations in applying ML/AI technology, with22% of those surveyed said that limited or lack of clean training data for ML or AI is one of their top three barriers in life science today. We see this as a new gold-mine for suppliers and service providers.

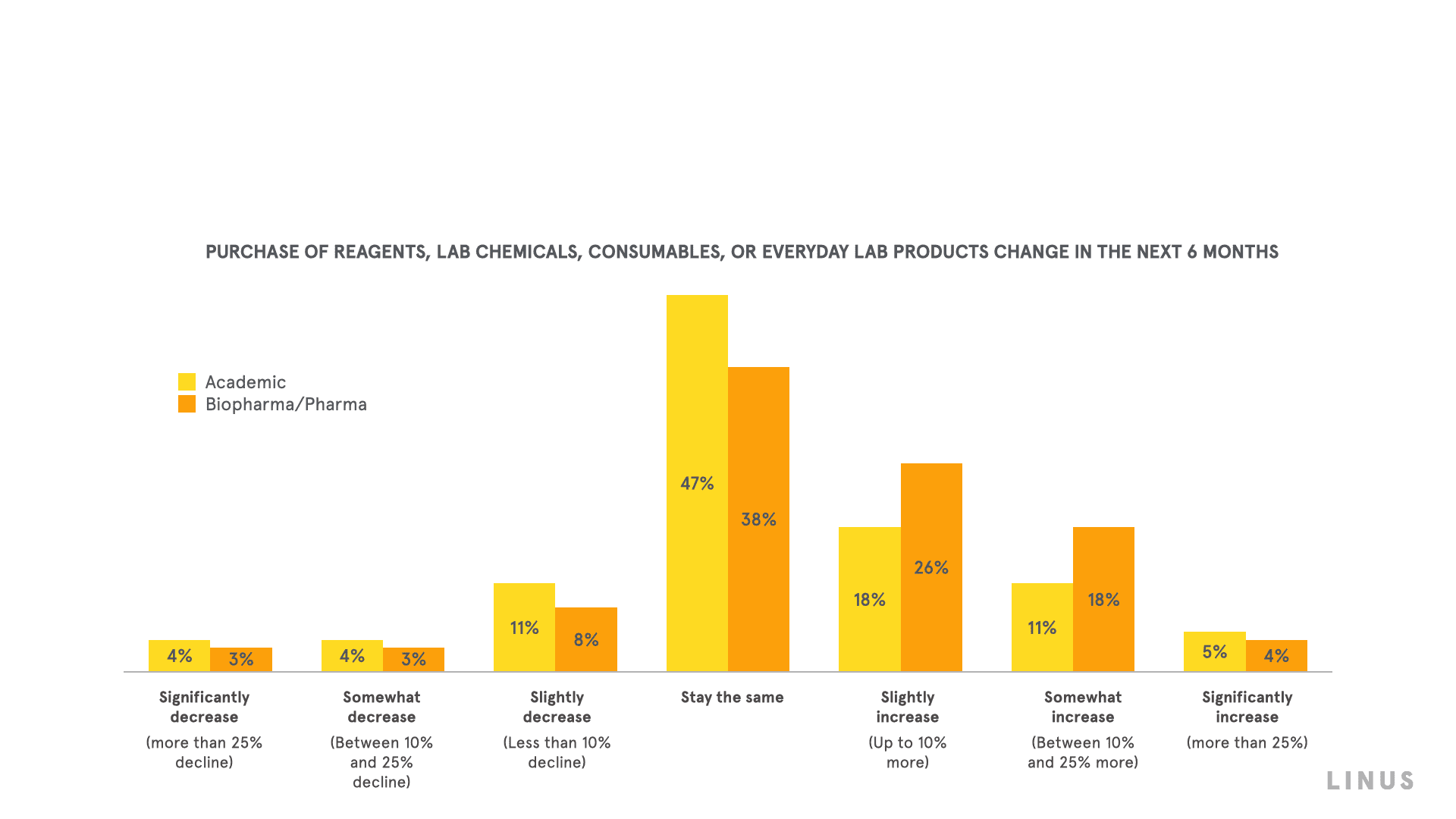

Regarding purchases for reagents, lab chemicals, consumables, and every lab products, we found that 81% expect their lab purchases to stay the same or increase. This is our most prominent signal that the supply hoarding of 2022 is now working its way through the labs and scientists will be in need of regular supply again, soon. Academics are more likely to expect no change in the next 6 months, while more in Biopharma/Pharma expect an increase.

Q: Compared to the last 12 months (from May 2022 to May 2023) how do you believe your purchase of reagents, lab chemicals, consumables or everyday lab products will change for the next 6 months? (n=454)

Even though half of all scientists in our survey stated an intention to purchase new technology in the second half of 2023, we found significant differences in purchase intention depending on scientific discipline. Of the 19 disciplines we surveyed, 7 were significantly higher, where at least 2 out of 3 respondents plan to purchase new technologies. These disciplines are molecular diagnostics/pathology, developmental biology, vaccine development, stem cell research, microbiology, drug discovery/development, and cell and gene therapy. This means that money is also tighter with the remaining 12 disciplines, suggesting that commercial executives would be wise to target their efforts by discipline and to avoid highly competitive environments with limited budgets.

Economic Outlook

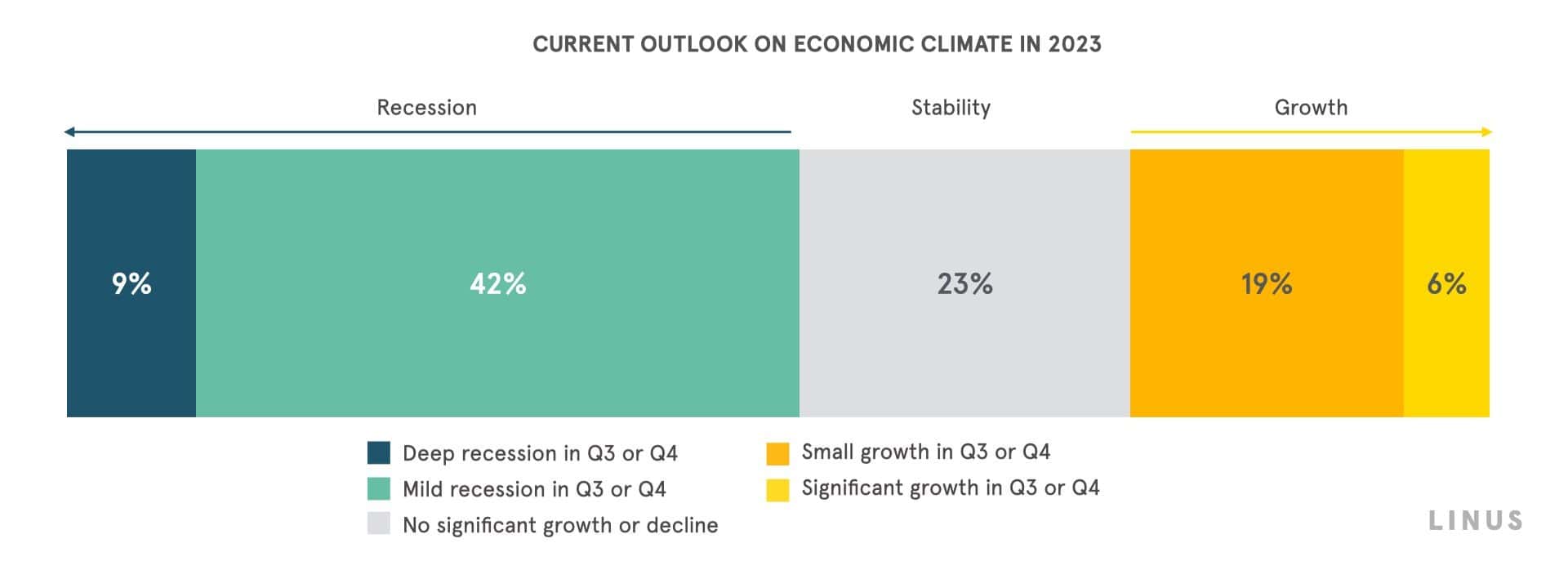

Overall, we see differing sentiments about the upcoming economic climate. About half or our respondents anticipate a recession and another half anticipate stability or growth in the 3rd and 4th quarter of 2023.

Q: What is your current outlook about the economic climate in 2023? (n=574)

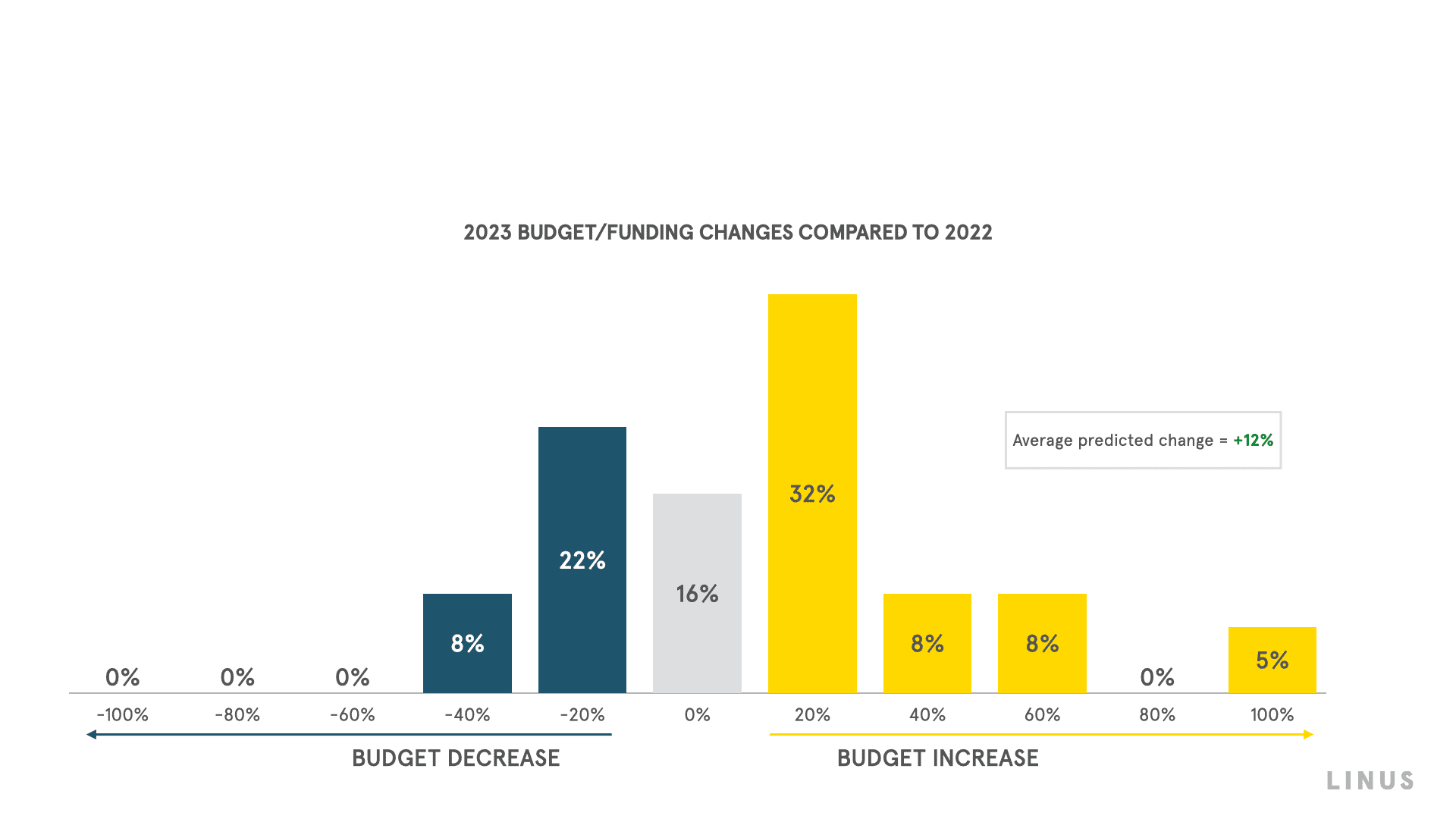

To better understand the drivers behind scientists’ perceptions about the economy, we asked about the sources of information that our respondents relied on in predicting the economy. Interestingly, those who predict economic stability or growth stated more direct sources of information than those who predict a recession. Specifically, among biopharma and pharma respondents who predict growth, 23% of scientists have been given the green light to spend more and another 15% have already received higher budgets or funding. Conversely, for those who expect a recession, the outlook of academics is born from secondhand information such as the general news media, and for those in biopharma and pharma, it’s more direct in the form of guidance to tighten expenditures (27%). Those in senior business roles (n=37) aren’t expecting dramatic changes in their budget.

Q: Compared with 2022, by what percent do you believe your funding or budgets will change in 2023? % between -100% and +100% [business roles only] (n=37)

Indications of Action

Just as economic pressures typically result in consolidation within industries, we are seeing similar consolidation even within the scientists’ own work. They are moving beyond an era of proliferating projects, guided by readily accessible, free capital, in favor of consolidating and investing more into higher priority initiatives. To capitalize on this moment there are three areas of action for the commercial executives to consider:

-

Predicting the economic outlook is hard, but scientists are bullish on their productivity this year. Scientists aren’t waiting for economic clarity to determine the course of their work. Races aren’t won when the tailwind pushes the entire pack forward, but when headwinds cause conservative actions amongst competitors, leaving the playing field open. Act now to be their partner.

-

Efficiency is the new superpower for your customer, as they embark on digital transformation. Implementing ML/AI is about much more than cost cutting for customers, and that drives opportunities for suppliers. They need know-how, data-sets and process transformation. Now is the time to double down on being their partner in this transformation.

-

Simple averages hide the stories. Some cohorts are especially proactive and productive right now. Knowing whom to target and whom to avoid, matching value propositions to the most likely customers is not as facile as bluntly targeting an industry or a sector, but it can be as simple as understanding which institutions are in a tight race for datasets, and focusing on supporting them.