SUMMARY

- The transition we saw in January from automation to AI continues, with 35% of our panelists expecting to adopt machine learning (ML) or AI in the next six months.

- Because only 12% of panelists look to AI tools (like Chat GPT) as a trusted source of information, a distinction must be made to this audience between AI integrated tools and generative AI.

- 52% of panelists in biopharma look to presentations and panels at industry events as a key source of trustworthy information.

- Sequencers are the #1 technology panelists plan to purchase in the next six months, supporting growing industry interest in multi-omics.

- Scientists across the industry plan to fortify their budgets, where 38% plan to apply for new sources of funding in the second half of this year.

This report is a portion of the dataset and information from our semi-annual State of Science survey. For additional information on particular segments or subsegments, please reach out to our team.

In the semi-annual LINUS State of Science survey, we explore how scientists around the globe are adapting their priorities, productivity, and mindset based on scientific and economic conditions.

As we move into the second half of 2024, we see increased opportunity for AI enablement and a need for distinction between generative AI and AI-integrated tools. Across the industry, trust will be a critical lever in connecting with scientific audiences for the remainder of the year. Scientists’ purchase intent suggests a growing interest in multi-omics, and economic outlooks are no longer a primary determinant of priorities for the next six months.

About Our Respondents

Through our digital research platform, LINUS surveyed nearly 400 scientists (n=395) from various regions, organization types, application areas, and levels of responsibility. This sample is meant to provide directional insights that represent sentiments in the life science industry. These insights are informed by scientists from North America (61%), Europe (27%), and APAC (11%), as well as the Middle East and Africa, and Central and South America.

Almost half (47%) of the respondents in this research work in an academic setting, 36% work for biopharmaceutical and pharmaceutical organizations, and the remainder are affiliated with life sciences research and development in contract organizations, hospitals, biotechnology, or manufacturing.

Exploring Priorities and Productivity

In the second half of 2024, priorities are largely the same as they were in the first half of this year. We’re seeing AI integration, new technologies, and new collaborations solidify their roles as key contributors to scientists’ productivity, providing critical support for addressing industry barriers in the next six months.

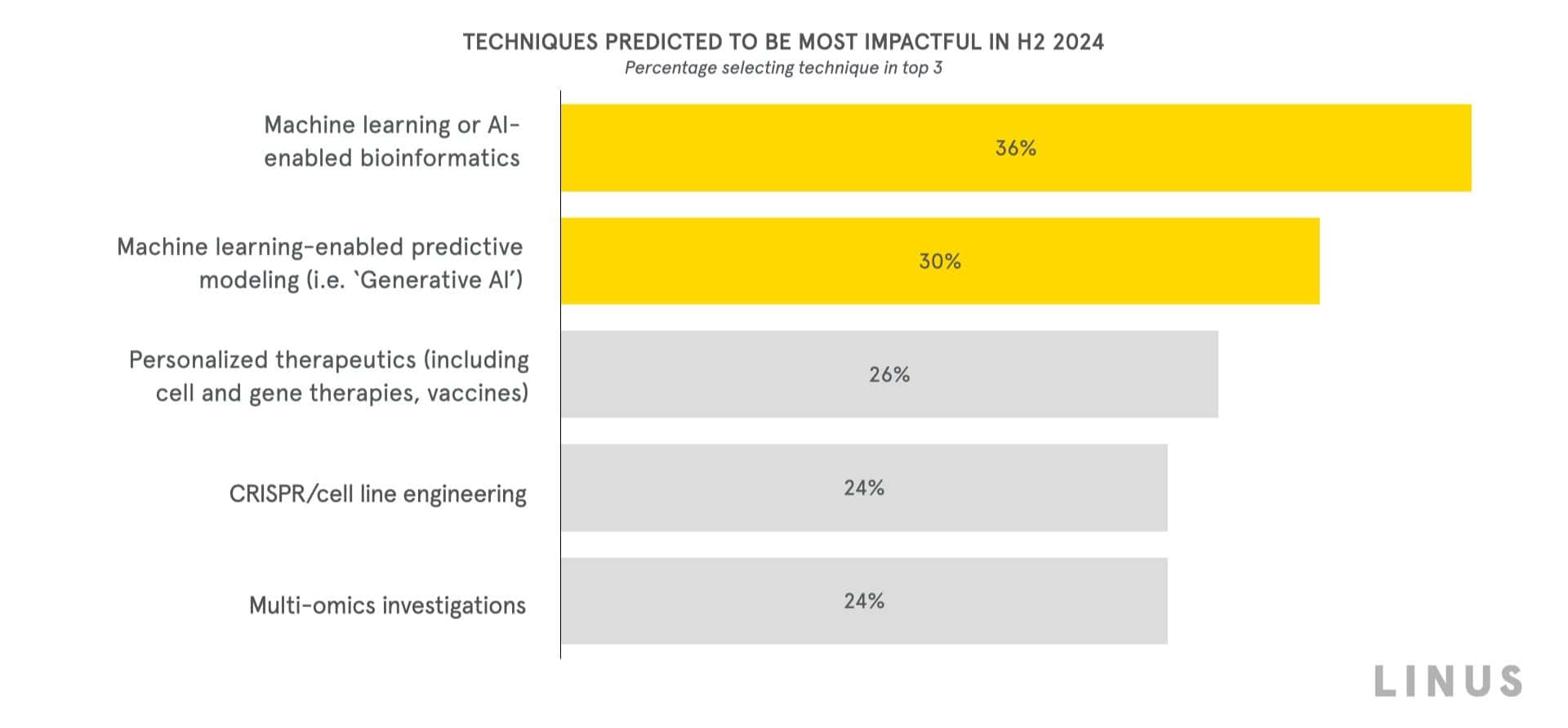

To better predict applications that may see growth in the next six months, we asked scientists which techniques they predict to be most impactful for the second half of 2024. Our respondents expect machine learning or AI-enabled bioinformatics to make the most significant contribution, followed closely by machine learning-enabled predictive modeling, or generative AI.

We see this interest in AI maintained through scientists’ top priorities, where 35% of respondents intend to adopt machine learning or AI in the next six months. The percentages of scientists who will prioritize machine learning and/or AI in academia (33%) and Biopharma (38%) are similar, indicating that AI will be a key opportunity to optimize workflows on both sides of the industry.

Further supporting the opportunity for AI to positively impact the industry, barriers to AI adoption are decreasing in significance. Inflated expectations surrounding ML and AI are no longer a top-five barrier in life sciences, and the percentage of respondents selecting limited or lack of clean training data for ML or AI as a top barrier in life sciences has dropped 3 points since the beginning of the year.

In January, we reported that integration of automated systems would be used by scientists as a transitional tool to prepare for later AI enablement. At this point in time, automated systems were the top technology scientists intended to purchase in the first half of 2024, and AI was tied for the third-highest purchase intent.

Now, scientists’ suggest that purchase intent has shifted. AI has passed automated systems to claim the #2 ranking in purchase intent for the second half of the year. From January to July of this year, automated systems have dropped from the #1 technology scientists expected to purchase to #3. This change suggests that scientists are moving further along the path from integration of automated systems to enablement of AI.

Sequencers were the top ranked technology scientists planned to purchase in the second half of 2024. When we look at broader industry trends in sequencing technologies, we see platforms like Singular’s G4X and Element’s AVITI24 integrating multi-omics characterization with an instrument class that was previously focused on DNA.

While new technologies provide new opportunities for the next six months, scientists will also navigate new barriers. Introduced as a potential option for the first time this year, instability of the job market has joined the top five barriers in life sciences. Job market instability is tied for the top barrier throughout the industry, and is expected to be especially impactful in academia.

Over half of our respondents from academia (61%) expect their productivity to be stagnant, if not lower, in the second half of 2024.

Q: How do you measure your productivity in your current position?

The proportion of this sector expressing confidence in their ability to meet productivity goals has decreased from 74% to 57% since January, where productivity is defined in terms of number and impact of publications, and level of funding received. In an effort to combat productivity challenges, academia’s top priorities include finding new collaborations, adopting new techniques, and recruiting more scientists or engineers.

New collaborations remain a top priority not just for academia, but also for the industry as a whole. In the second half of the year, 37% of our respondents will prioritize finding new collaborations or external partners in their work. These results are similar to the data we saw in January, suggesting that scientists will continue to take tangible action in seeking partnerships through the end of 2024.

Furthermore, we see alignment between the project types in which scientists are seeking new collaborations, and the techniques they predict will be most impactful in the second half of this year.

Q: Considering current scientific advances, which are the top 3 techniques or applications in life science research and development that you believe will make the most significant contribution or impact in the second half of 2024?

Respondents are most often looking for partners in their work related to translational research, clinical research, and omics. These types of workflows correspond to CRISPR and cell line engineering, personalized therapeutics, and multi-omics investigations, all of which scientists believe will make a significant contribution to the industry in the next six months. For technology developers and solution providers, this presents a key opportunity to provide support to scientists with meeting their needs in these applications.

The Importance of Trust

As scientists continue to prioritize new partnerships and collaborations in the second half of 2024, these partners’ ability to build trust will be critical in connecting with scientific audiences. In alignment with our six predictions for life sciences at the beginning of this year, barriers related to trust are now growing in influence, highlighting a key opportunity for collaborators to address these concerns.

The politicization of scientific topics is one area in which we begin to see the impact of trust-related barriers.

Politicization of scientific topics is especially impactful for academic scientists, where over a quarter believe it is a top barrier in their work. But when compared with sentiments at the beginning of the year, scientists across the industry have maintained that politicization of science is a top barrier in the broader life science space today.

Although AI adoption is a top priority as scientists move into the second half of the year, AI tools like Chat GPT were among the least trusted sources of information; only 12% of respondents look to such AI tools for information about their application or industry. This dissonance is likely because, although they see AI as an opportunity to streamline workflows and help improve productivity, scientists see this opportunity as separate from AI’s ability to act as a source of information. Therefore, when connecting with this audience through AI, it will be critical to make a distinction between AI-integrated technologies that build on current capabilities, and generative AI that provides new information and still may be a source of doubt.

Purchasing and Economic Outlook

When compared with perspectives at the beginning of this year, scientists’ economic outlooks are stabilizing. Segments of our respondents who had especially positive or negative outlooks in January are now reporting sentiments that are less extreme. With a more balanced view of the economy, scientists’ plans for the rest of the year seem to transcend economic outlooks.

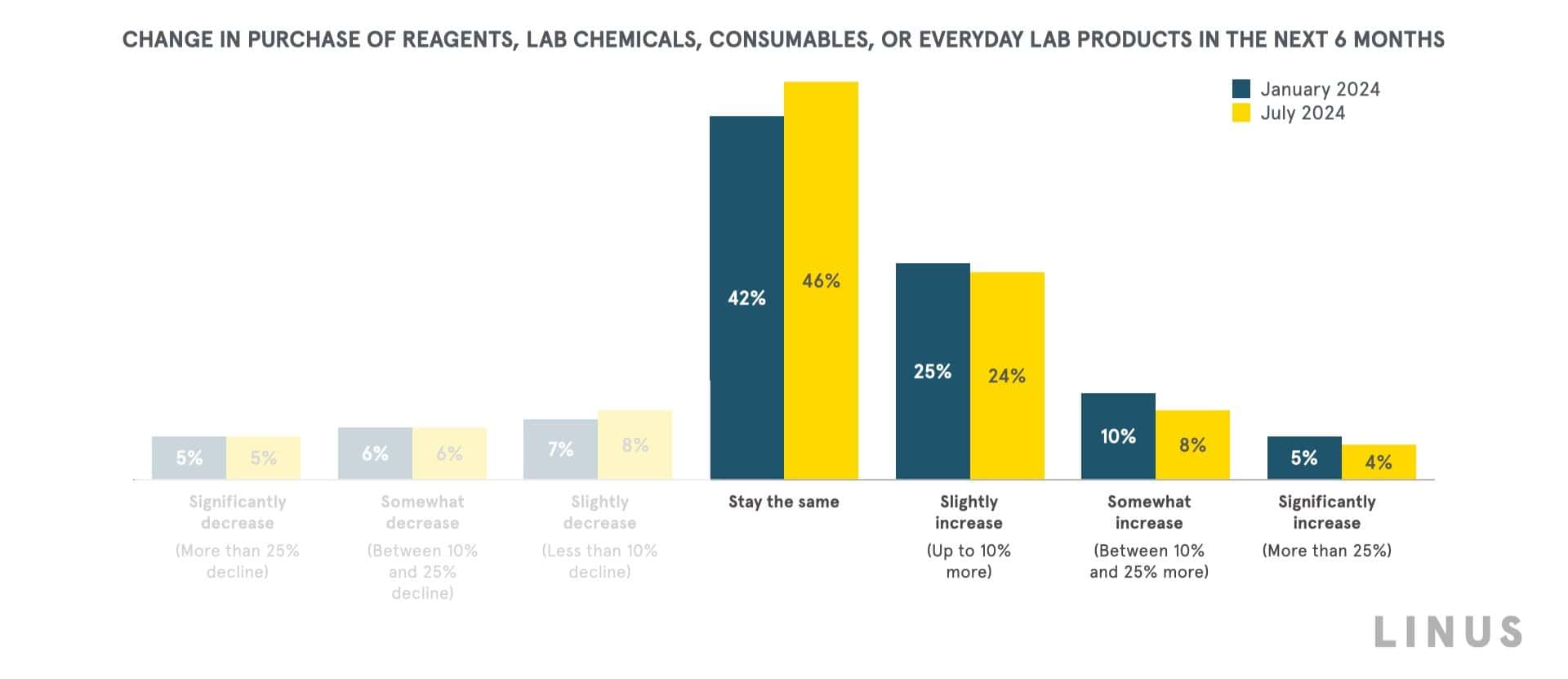

While 70% of our respondents believe the cost of scientific equipment, reagents, and consumables will increase in the next six months, purchase intent for those consumables is seemingly unaffected by increasing costs.

As of July 2024, 46% of our respondents believe their purchases of everyday lab products like consumables will be maintained in the next six months. An additional 36% believe their purchases of these products will slightly, somewhat, or significantly increase in the second half of the year. For biopharma specifically, almost half (47%) attribute the increase in lab product purchases to a need for more data; an increase of 20 points since January of this year.

Conversely, purchase intent for instruments remains quite low. Only 41% of our respondents plan to purchase a new technology in the next six months, following an uncharacteristically low Q1 purchase intent in January. Here, we see signals that scientists are making intentional purchasing decisions in the latter half of 2024, prioritizing sequencer and consumable purchases.

Economic outlooks for the rest of 2024 still seem uncertain, and resemble scientists’ predictions in January.

We still see a fairly even split between those who predict recession and those who predict stability or growth. However, the proportion of respondents predicting recession has decreased since the beginning of the year, and the proportion predicting stability has increased. The same is true for regional outlooks in Europe; where Europe had the most negative economic outlook at the beginning of the year, the proportion of European respondents predicting recession has now decreased 22 points. Additionally, the proportions of respondents in academia and biopharma predicting economic stability have increased by 6 points and 5 points, respectively. This combination of signals tells us that economic outlooks across the industry are becoming less extreme than they were in January.

As economic outlooks stabilize, priorities in life sciences are homogenizing. When we ask scientists about how they are preparing for the next six months given their economic outlooks, responses usually vary by economic outlook.

Respondents are now preparing for the next six months in similar ways, regardless of whether they predict economic recession, stability, or growth in the second half of the year. Across life sciences, this audience will be applying for new sources of funding and bringing more work in-house to reduce costs.

Opportunities for Action

- After prioritizing automation in the first half of 2024, scientists are continuing to move further along the automation path toward AI integration. We predict this transition will continue into next year, where we will likely begin to see a drastic increase in AI enablement in scientific labs by the second half of 2025.

- When we look at new technologies entering the space, especially in the sequencer category, we see a trend toward broader sequencing perspectives that include multi-omics analysis. As we predicted in January, our research suggests that multi-omics is increasing in its potential for impact in the second half of the year. When we look at scientists’ plans for new collaborations, we see intent to seek partners with expertise in omics-related workflows; this aligns with respondents’ prediction that multi-omics is among the applications that will make the most impact in the next six months.

- Overall, respondents will make careful decisions in budgeting and purchasing to navigate increasing costs. Even as economic outlooks are stabilizing, 70% of our respondents believe that the cost of everyday lab products will increase in the next six months. In response, they will become more intentional with their financial decisions. Purchases of consumables and reagents will still be maintained or increase, but scientists will also prioritize new sources of funding and bringing workflows in-house.