2024 State of Science: Consumer Sentiment in Life Science

SUMMARY

In our semi-annual State of Science survey, we explore how scientists around the globe are adapting their priorities, productivity, and mindset based on scientific and economic conditions.

In 2024, we found that scientists plan to do more with less and are looking outside their own organizations to advance their research, that there is a growing interest in automation, and that changing concerns over the impact of external forces on life science uncover an opportunity to build trust.

About Our Respondents

Using our digital research platform, we surveyed nearly 400 scientists (n=398) representing multiple geographies, organization types, applications areas, and levels of responsibility. In total, this group represents a directional sample for the industry. This survey is composed of scientists from North America (57%) Europe (28%), and APAC (13%) with the remainder from Middle East/Africa and Central/South America.

Over half (56%) of respondents work in an academic research setting, 21% of respondents work in pharmaceutical and biopharmaceutical research or development, and the remaining respondents represent a spectrum of related research and development activities in hospitals, contract organizations, drug development, or manufacturing.

Scientific Priorities

This year, scientists are pledging to do more with less. Automation, AI / ML, and new collaborations will lead the charge in increasing confidence to meet sustained or increased productivity goals over 2023.

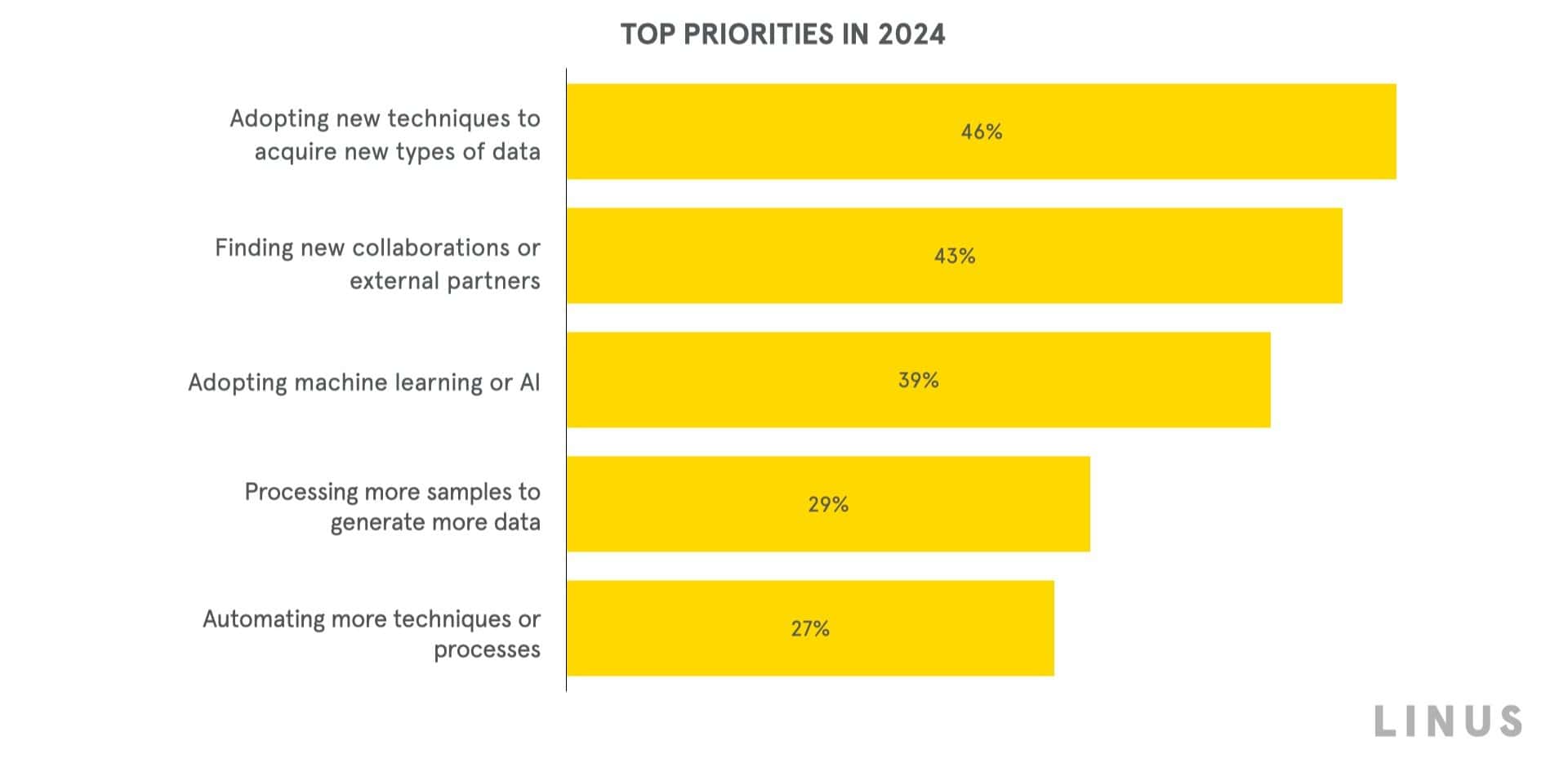

To understand where scientists plan to focus their efforts this year, we asked respondents to select what they believe to be their top 3 priorities in their 2024 work.

We heard from our panel that identifying new partners and automation are key actions, with 43% of respondents saying that finding new collaborations or external partners and 27% saying automating more techniques or processes are top priorities this year.

Of those respondents who are prioritizing new collaborations, we found through unaided response that 19% are seeking partners for translational research (drug discovery and development, animal models, and genetics) and 11% are looking for partners in clinical research (clinical trials and related projects).

Also notable within this trend of finding new partners; 42% of respondents intend to increase the number of projects they outsource in 2024.

These outsourcing plans span the drug development process. Target identification, manufacturing, supply or customization of materials, and clinical trial design are all areas of life science where respondents are more likely to be outsourcing workflows than insourcing.

On the contrary, nearly half our respondents indicate that they plan to insource assay development — almost twice as many respondents than who plan to outsource.

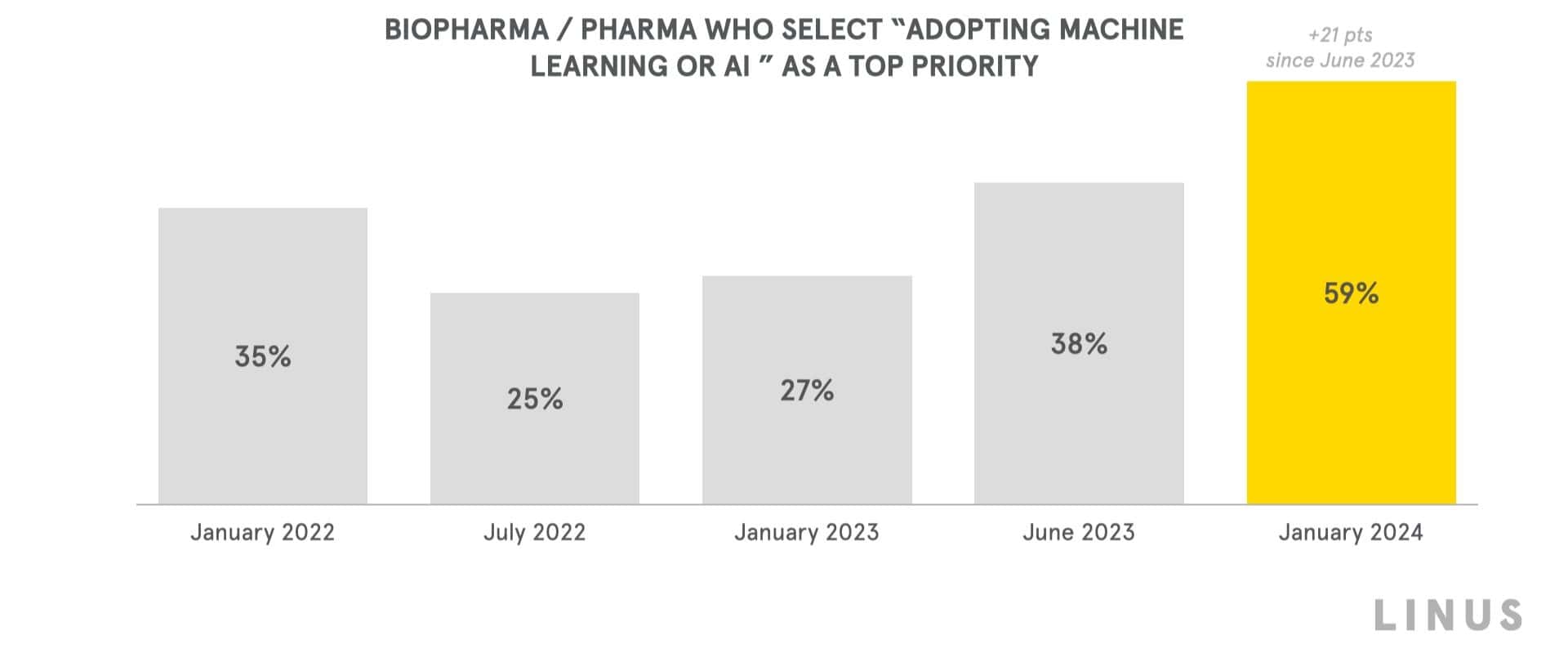

Regarding scientists’ priorities to generate new and more data, interest in machine learning and AI continues to rise. Scientists see automation as a stepping stone, a transitional tool to begin leveraging ML and AI in increasing productivity.

In 2024, we’re seeing the highest recorded interest in ML and AI adoption from biopharma / pharma: up 21 points since we last surveyed scientists in June 2023. This is the year we’re finding that automation and AI adoption has surpassed mere talk to actual, tangible solutions aimed at maximizing productivity.

We believe that those organizations that overcome the AI hype barrier and deliver on a promise of helping scientists increase productivity are poised to win.

Productivity

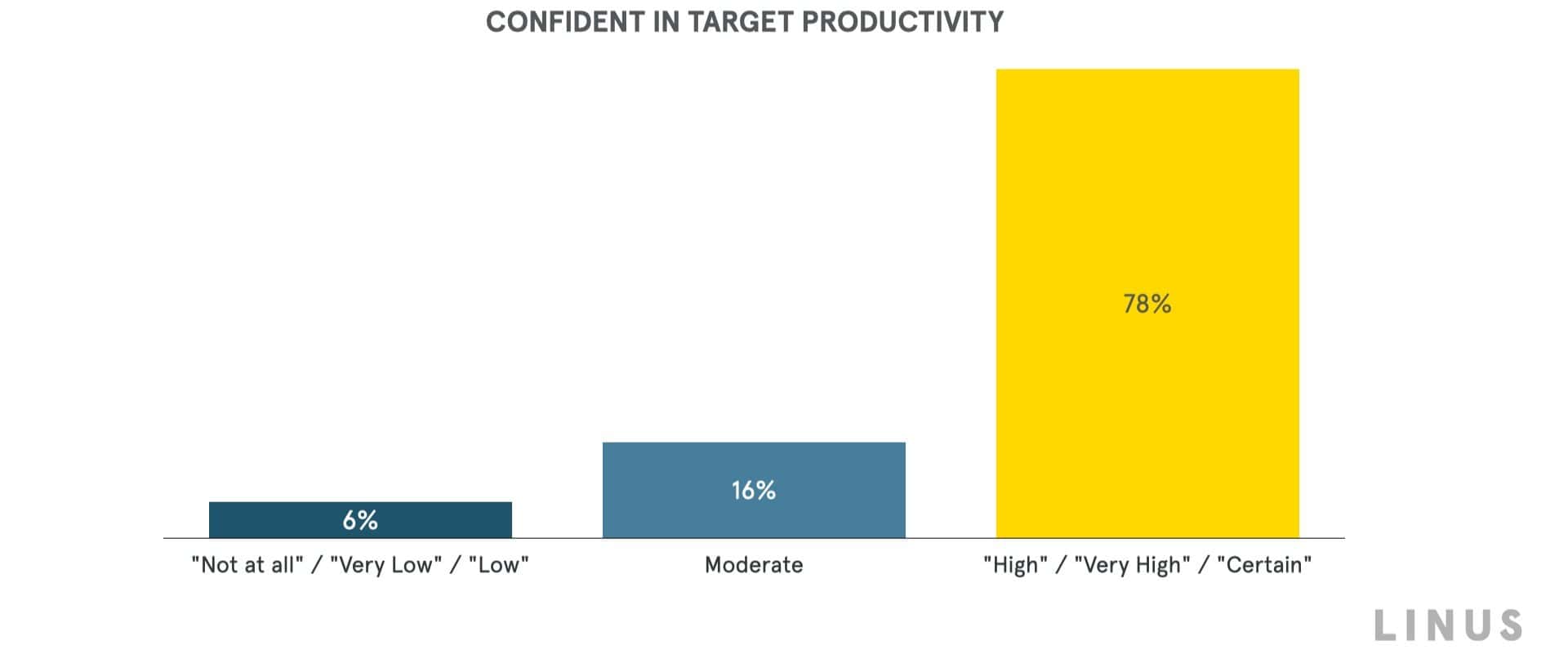

When it comes to productivity in 2024, scientists are highly confident that they will meet their goals.

Those in biopharma and pharma are the most confident about their productivity in 2024, with 88% saying they are highly confident or certain they will meet their goals in 2024. Because this cohort is especially driven to incorporate ML and AI in 2024, paired with high confidence that they will achieve their goals, we see that those in biopharma and pharma will aim to do more with less to maintain and grow productivity.

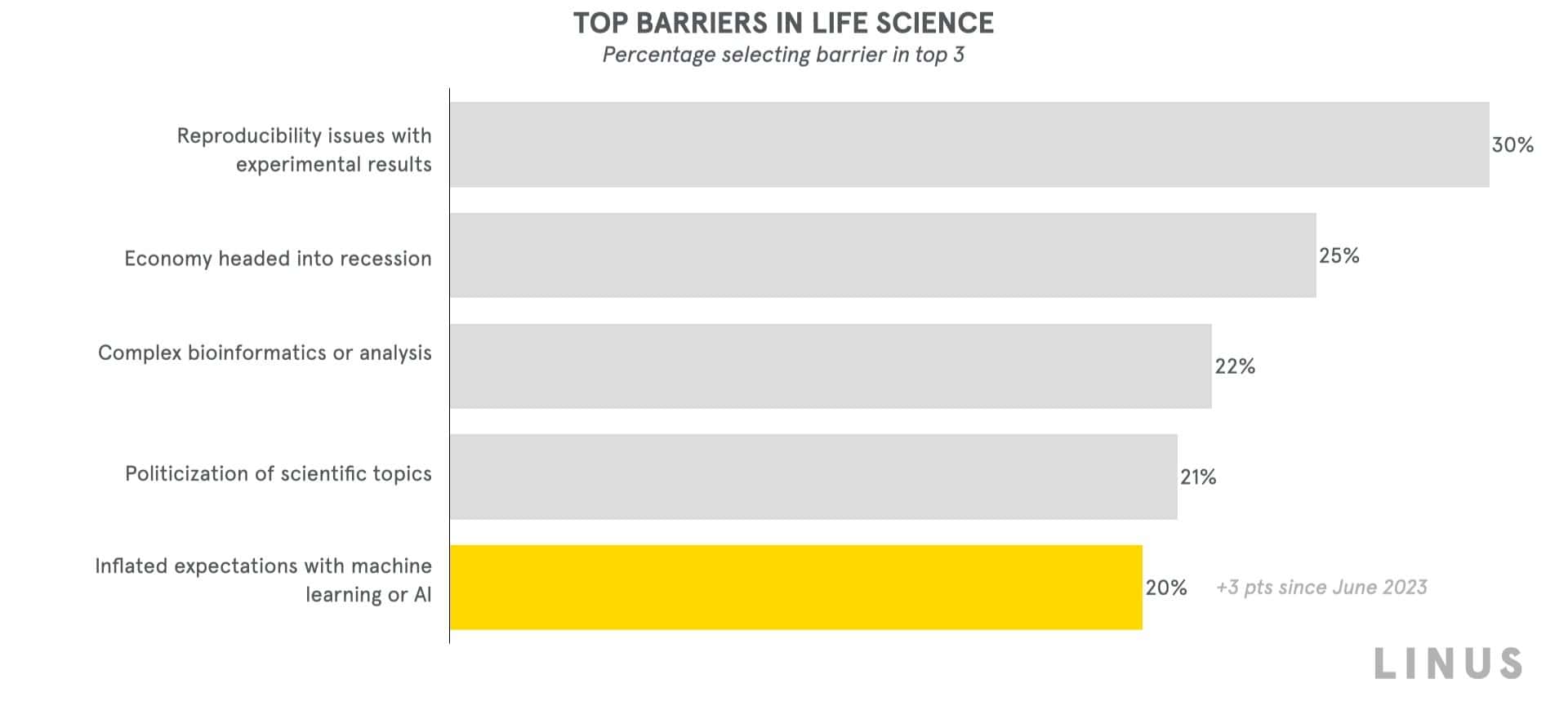

For those who are anticipating higher productivity in 2024, many cite AI and automation as top contributors. Yet despite high hopes for AI in 2024, inflated expectations have joined the top 5 barriers in life science today.

Digging deeper into this concern, we found that biopharma and pharma seem especially skeptical about the ability to seamlessly integrate AI into current workflows. A quarter of these respondents say that inflated expectations with machine learning or AI and limited or lack of clean training data for machine learning or AI are top barriers.

Scientists are turning to automation in the meantime to mitigate these concerns, ranking automated systems as the #1 technology type they intend to purchase. In our cohort, those who have already integrated robotics and automation predict it will represent almost a third of their budgets in 2024.

Economic Outlook

As the overall economic outlook continues to improve, scientists face new forces impacting their spending habits – and their science. Priorities in 2024 will shift toward exploration and opportunity, threatened by the politicization of scientific topics.

When compared with previous years we’ve distributed this survey, we’re seeing the lowest Q1 purchase intent yet. Only 53% of respondents indicated that they will plan to purchase new technologies in the coming year, versus 63% in 2022 and 68% in 2023.

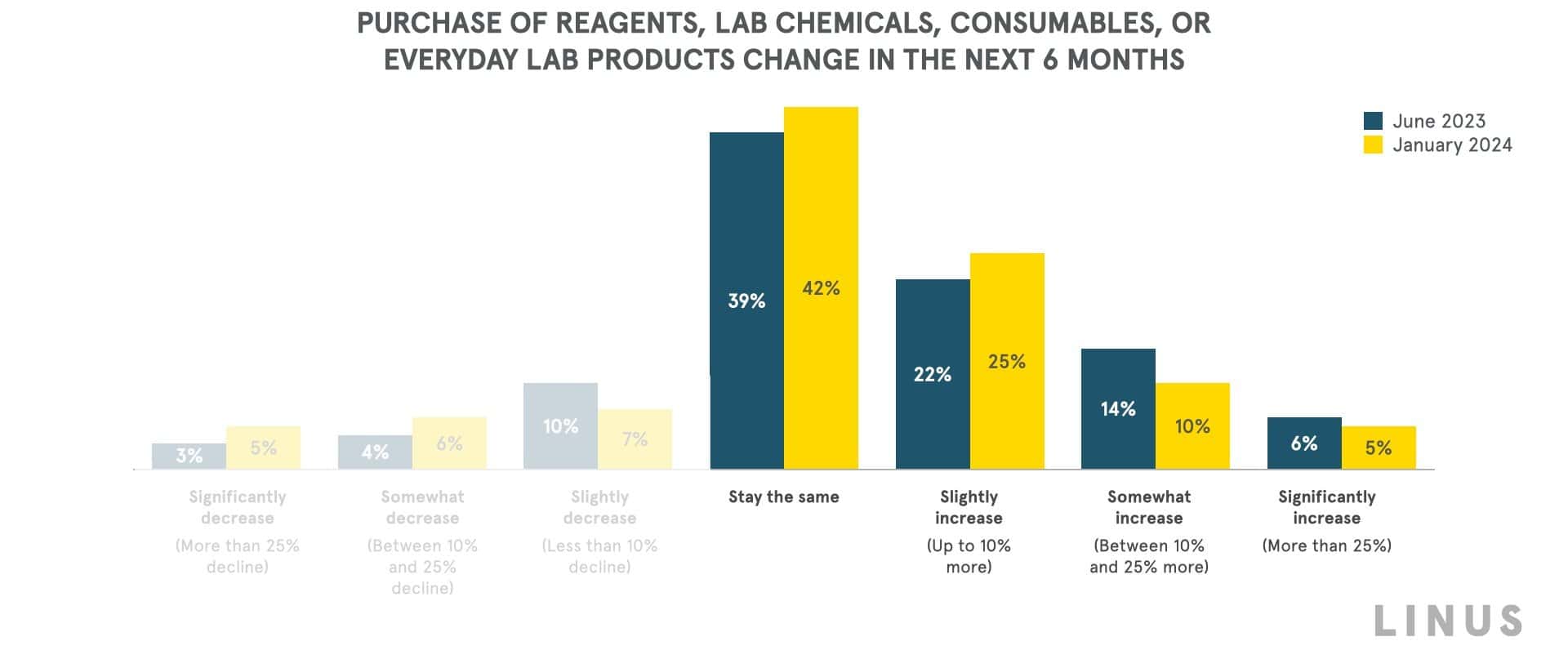

Purchase intent for everyday lab products, however, remains stable when compared to mid-2023. Of those who predict an increase in lab product purchases, almost a third cite an increasing need for more data as the primary reason.

Overall economic expectations seem largely uncertain in the beginning of 2024, with new factors impacting scientists’ outlook for the coming year. However, there are still pockets of optimism.

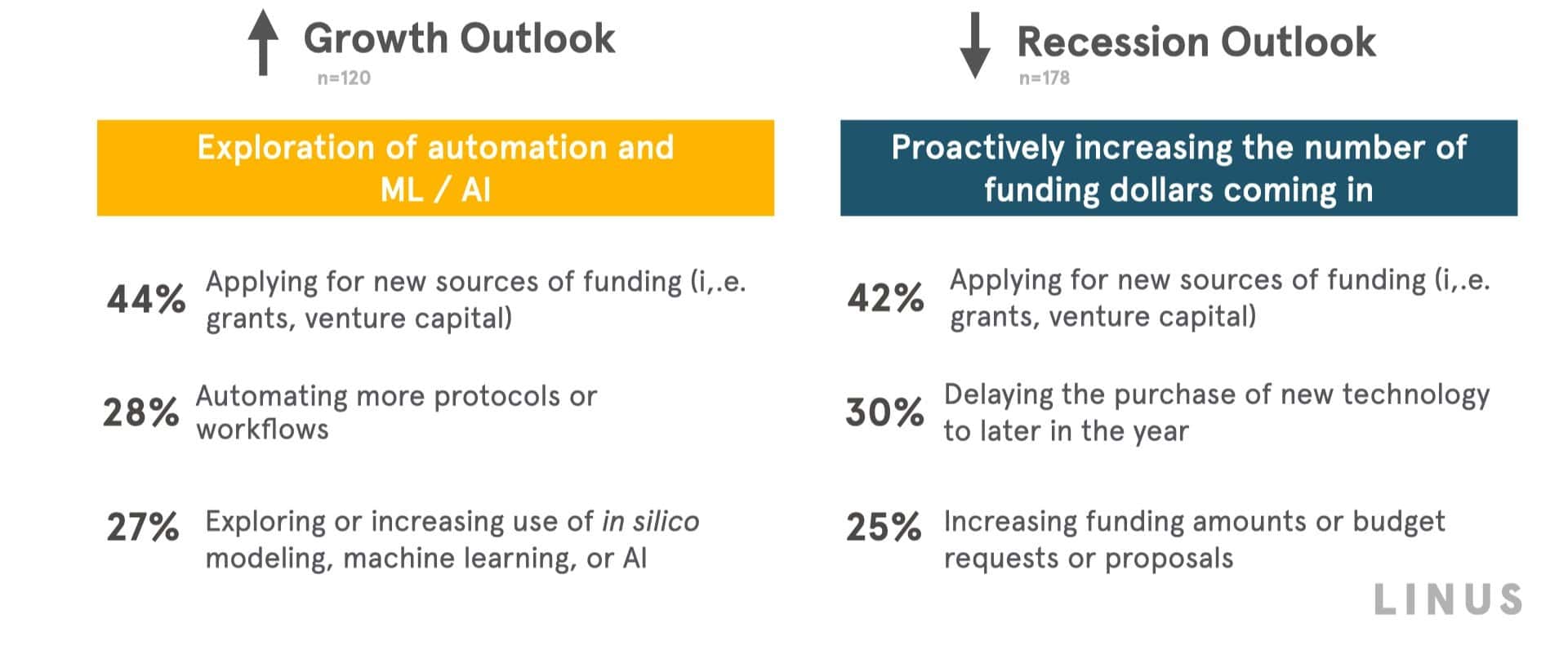

In 2024, we see inconsistency in the economic outlook for 2024: about half of respondents anticipate recession and half anticipate stability or growth. However, economic expectations are most positive among those in biopharma or pharma. For this group, both internal and external budget increases are signaling economic growth in the new year.

Those predicting a recession are prioritizing new funding opportunities to prepare, while those predicting economic growth plan to explore AI and automation.

Barriers

Compared with our previous State of Science studies, we’re seeing that barriers in life science are evolving and are no longer limited to experimental factors or economic conditions.

Over 20% of respondents selected politicization of scientific topics as a top barrier. Added for the first time this year, politicization of scientific topics is already predicted to be a top-5 barrier in life sciences in 2024 alongside reproducibility issues and economic recession.

Summary

The consumer sentiment of our advisory respondents leads us to believe that they are heading into 2024 with a mindset to do more with less. Our respondents intend to increase their productivity through the use of automation and collaboration.

Overall, we see a sense of optimism — if you know where to look — within the life science industry. Interested in learning more about how to apply these insights, and leverage our trusted panel of experts to enhance your commercial strategy? Contact us to discuss a specific partnership tailored to your needs.