Summary

The life sciences industry is in a significant state of flux, shaped by scientific breakthroughs, economic shifts, and societal pressures. To help leaders navigate this complex environment, The LINUS Group conducts a semi-annual State of Science survey, exploring the adapting priorities, productivity, and mindset of scientists worldwide.¹ In short, we measure the consumer sentiment of scientists to better gauge how they will navigate their work in the coming 6 months. Our latest report, “The State of Science in 2025: Outlook on the Life Science Market,” synthesizes insights from 450 scientists across the globe, surveyed between May and June 2025, to provide a comprehensive outlook for the second half of the year.²

This post and the report represent the collective sentiment of the survey respondents, and not necessarily the opinions of LINUS.

Here’s a deeper look into the key findings from our report:

1. The Growing Impact of Geopolitics on Scientific Endeavors

Global geopolitical dynamics are casting a long shadow over the life sciences, with academic scientists feeling the impact most acutely.³ Our report reveals that the “politicization of scientific topics” has become the top barrier in life sciences, a sentiment that has grown significantly since the beginning of 2025.⁴ In the U.S., half of the scientists surveyed expect public trust in science to decline in 2025.⁵ This growing concern is not just an abstract fear; it has tangible consequences for research funding and public engagement.

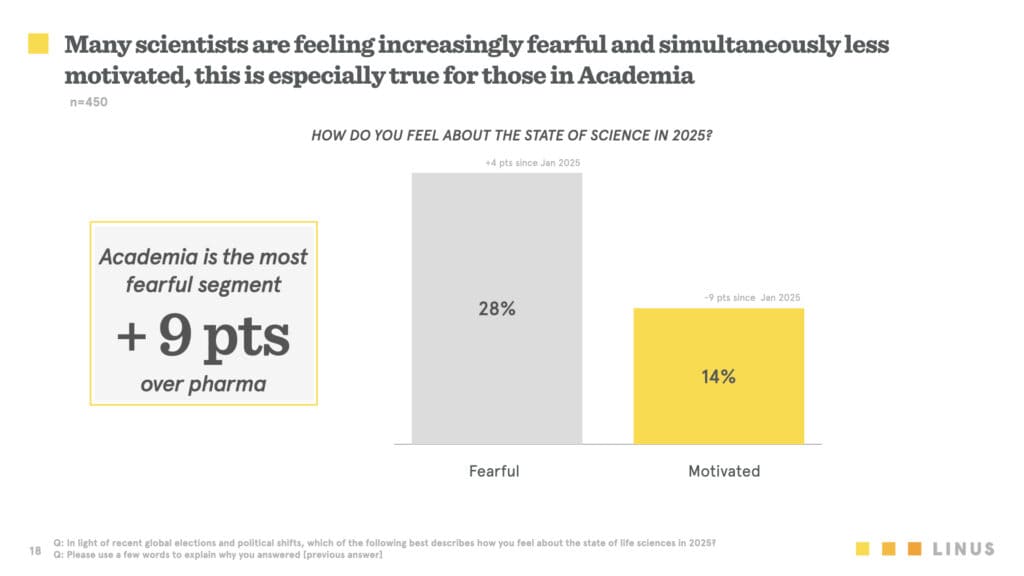

This sentiment is also taking a toll on morale. Scientists are now twice as likely to feel fearful (28%) than motivated (14%) about the state of science in 2025.⁶ This feeling is particularly pronounced in academia, which is 9 percentage points more fearful than the biopharma sector.⁶

Our full report dives deeper into these nuances and answers, how are different sectors of the life science community responding to this challenge?

2. Economic Uncertainty and Sector-Specific Resilience

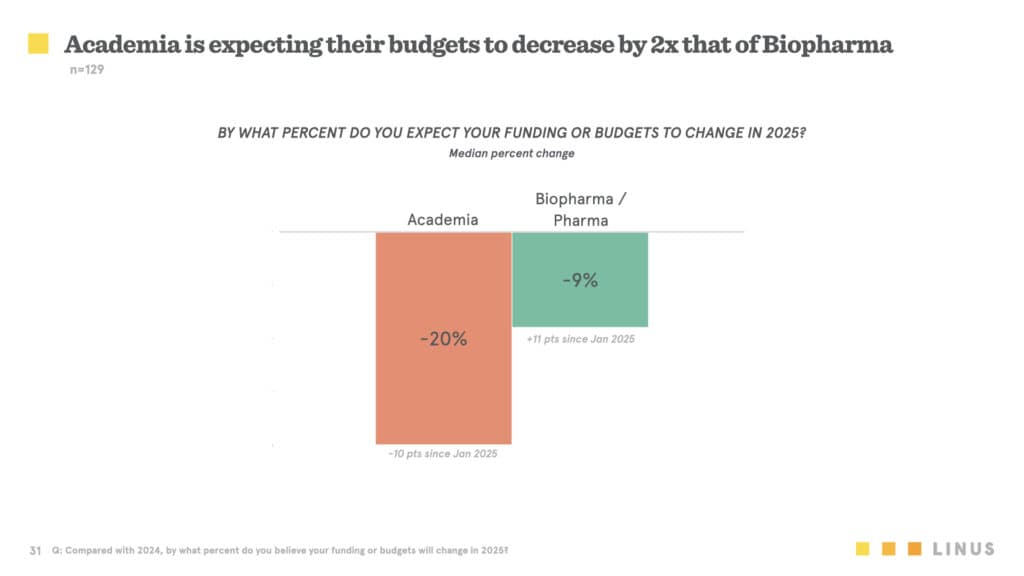

Fears of a recession are prevalent, with 71% of scientists anticipating an economic downturn in the latter half of 2025.7 This sentiment, which has seen a 26-point jump since January 2025, is particularly strong in North America.8 These concerns are translating into budget anxieties, especially within academia, where scientists expect their budgets to decrease by twice as much as their counterparts in biopharma.9

Despite these headwinds, the pharma and biopharma sectors are demonstrating remarkable resilience. Their purchasing behavior for lab essentials remains more consistent compared to academia, which is predicting a drastic decline in purchasing for the remainder of 2025.10,11 The full report provides a detailed breakdown of purchasing intent across different product categories and market segments.

3. The Unstoppable Rise of AI and Evolving Research Priorities

Artificial Intelligence is no longer a futuristic concept but a present-day priority for scientists. While AI is the top overall priority, when it comes to instrument purchases, sequencing tools have reclaimed the top spot for 2025.12 This indicates a dual focus on leveraging computational power for data analysis and investing in technologies that generate vast amounts of data.

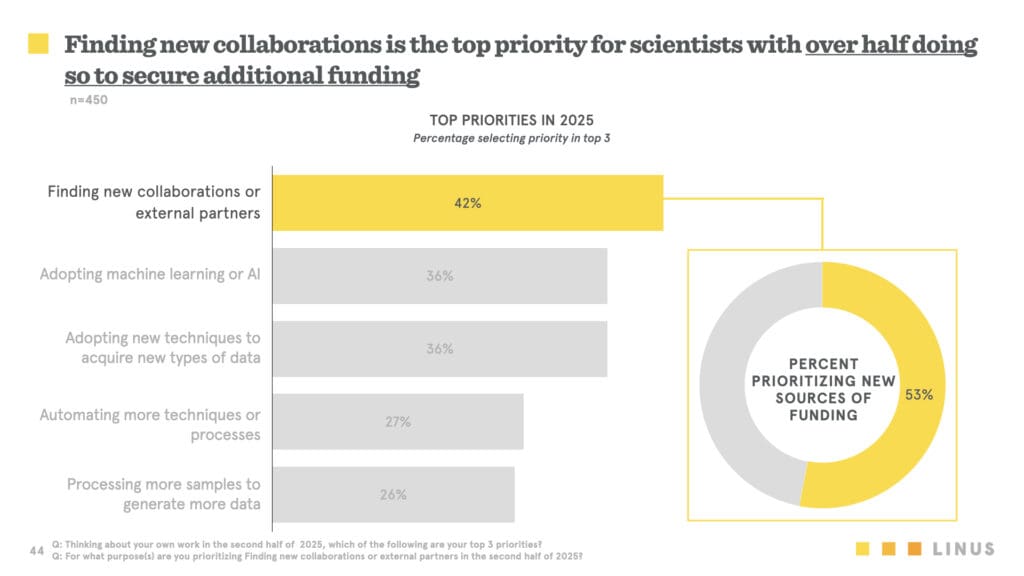

The report also highlights a significant shift in strategic priorities. “Finding new collaborations or external partners” has jumped to the top of the list for scientists, primarily to secure additional funding.13 How are these shifting priorities impacting research workflows and the adoption of new technologies? Our comprehensive analysis provides the answers.

4. Key Implications: What This Means For You

The findings from our 2025 State of Science report paint a picture of a community grappling with a triad of interconnected challenges: economic instability, the need for continued investment in innovation, and the pressure of balancing budgets. For life science marketers and leaders, navigating this landscape requires a nuanced and strategic approach.

- Tailor Your Value Proposition: The definition of success differs starkly between sectors. Biopharma measures success in terms of commercialization milestones, while academia prioritizes publications and funding. Your marketing and sales messaging must be tailored to these distinct motivations.

- Emphasize Partnership Over Products: With budgets constrained, especially in academia, customer support and true partnership can be leveraged as powerful differentiating factors. Emphasize how your solutions drive efficiency for biopharma workflows or enable the high-impact publications that are the currency of the academic world.

- Empower Scientists to Build Trust: There is a clear need for increased public communication to combat the politicization of science, yet few scientists feel equipped to take the lead. By first earning your customers’ trust, you can spotlight their achievements and empower them to confidently lead public conversations about their work.

Unlock the Full Picture

The insights presented here are just the tip of the iceberg. The full “State of Science in 2025” report provides a wealth of data and analysis to help you make informed decisions, including:

- A detailed breakdown of budget and purchasing trends across different regions and sectors.

- In-depth analysis of the factors influencing productivity and confidence among scientists.

- Actionable insights on how to effectively engage with academic and biopharma audiences in the current climate.

Don’t navigate the complexities of the 2025 life science market with an incomplete picture. Click here to purchase the full report or contact us directly to discuss how our specialized data analysis can provide you with the tailored insights you need to succeed.

References from the Report:

¹ Page 5: Overview

² Page 6: Our Approach

³ Page 4: Key Finding 1

⁴ Page 12: Politicization of scientific topics has become the top barrier

⁵ Page 13: Public trust in science is still top of mind

⁶ Page 11: Academia is the most fearful segment

⁷ Page 22: Many scientists are expecting economic decline

⁸ Page 25: North America is the least optimistic

⁹ Page 31: Academia is expecting their budgets to decrease by 2x that of Biopharma

¹⁰ Page 33: Biopharma purchasing remains consistent year over year

¹¹ Page 36: Academia predicts a drastic decline in purchasing

¹² Page 37: Sequencing capabilities have returned to being the top priority

¹³ Page 44: Finding new collaborations or external partners