2025 State of Science: Consumer Sentiment in Life Sciences

SUMMARY

This report is a portion of the dataset and information from our semi-annual State of Science survey. For additional information on particular segments or subsegments, please reach out to our team.

This year’s shifting political climates mean that scientists will look to collaborate within the life sciences community, while increasing external communication and engagement to reestablish trust with the general public. With expected economic conditions remaining stable, collaborators who can provide new sources of funding and empower life science organizations in adopting AI tools will be most valuable to this audience. Overall, most scientists are confident they will meet their productivity goals this year.

Through our digital research platform, LINUS surveyed over 400 scientists (n=404) from various regions, organization types, application areas, and levels of responsibility. This sample is meant to provide directional insights that represent sentiments in the life science industry. These insights are informed by scientists from North America (56%), Europe (31%), and APAC (10%), as well as the Middle East and Africa, and Central and South America.

Almost half (45%) of the respondents in this research work in an academic setting, 29% work for biopharmaceutical and pharmaceutical organizations, and the remainder are affiliated with life sciences research and development in contract organizations, hospitals, biotechnology, or manufacturing settings.

While the topic of trust between scientific communities and the general public has permeated industry conversations throughout the last year, scientists expect consequences related to the politicization of science to come to a head in 2025. Even in the face of such a trust deficit, leaders in life sciences feel called to action and plan to prioritize communication to build relationships outside of the scientific community.

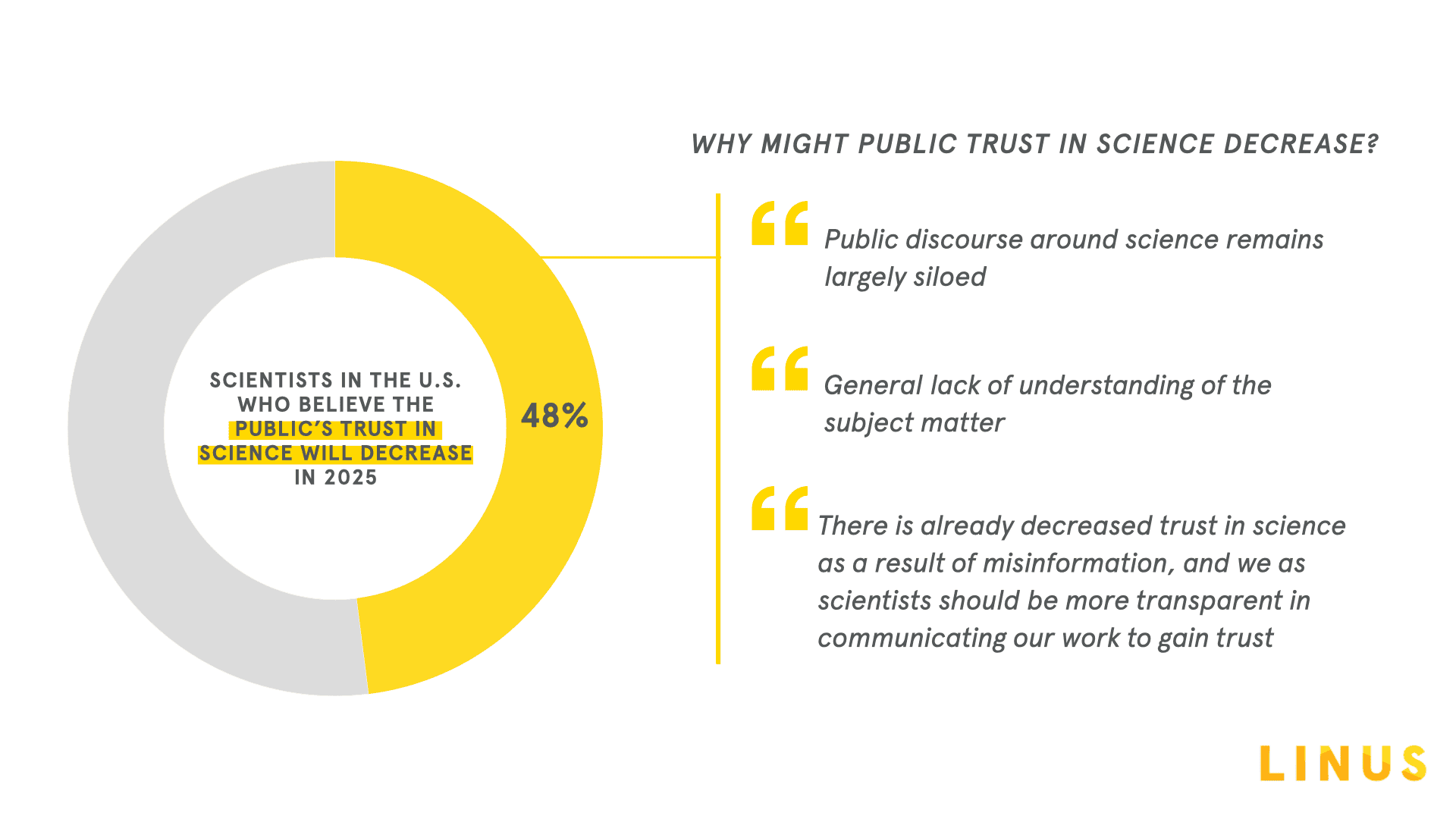

When we asked scientists around the world how they expect the public’s trust in science and scientists to change in the next six months, respondents in the United States were especially concerned with a perceived separation between those in and outside of scientific communities. Nearly half of our respondents in the US indicated they expect trust in science to decrease in the first half of the year, driven largely by a lack of effective communication between scientists and the public.

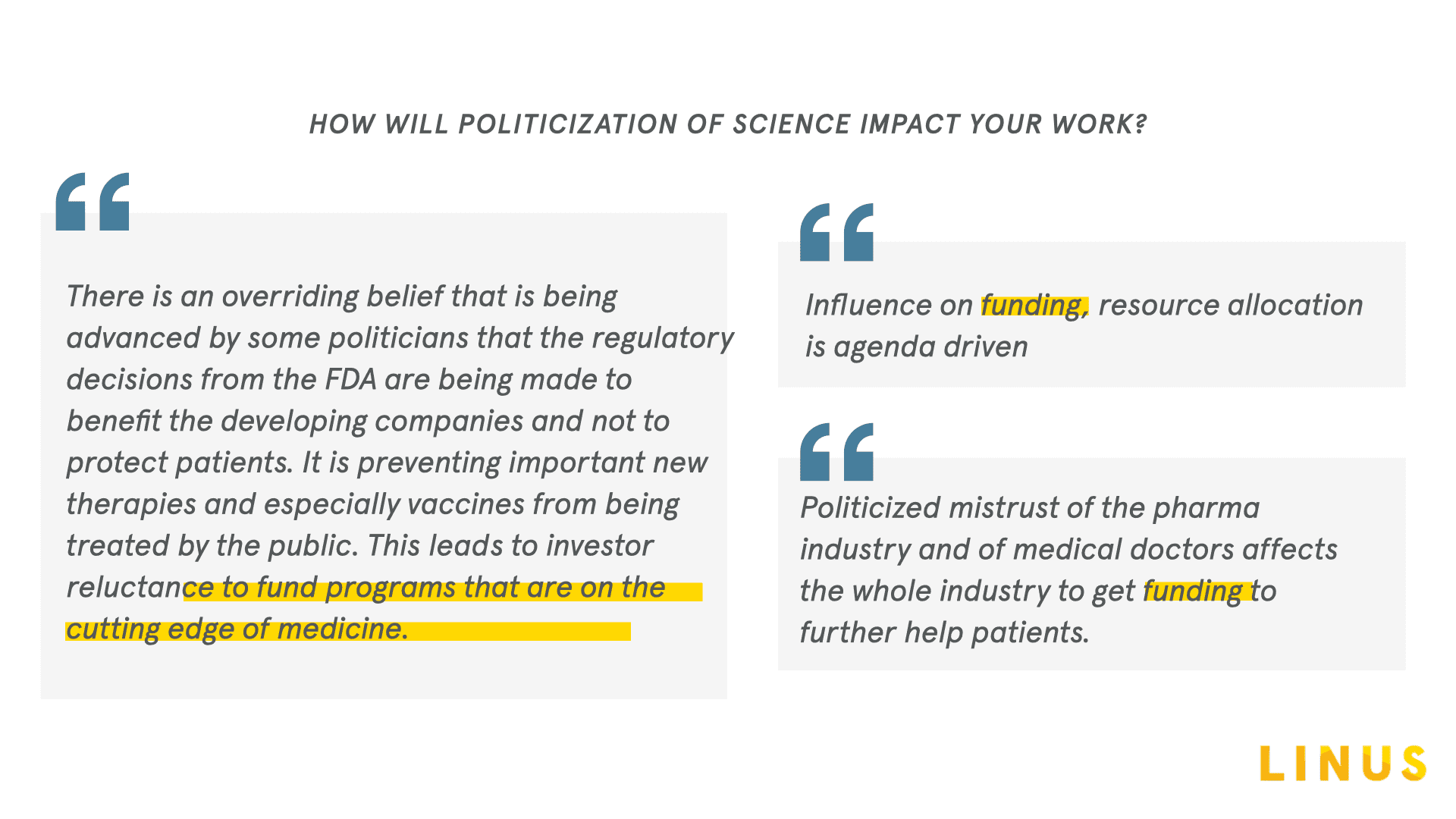

Scientists now expect politicization of scientific topics to be the top barrier in life sciences this year, representing an additional dimension to the gap in trust between scientists and the public. Not only are scientists expecting the general public to trust them less, they also display a level of distrust toward the public; expecting voices outside of the industry to politicize scientific topics to a level that will present a challenge to their work in 2025.

Academic and biopharma scientists are aligned in their expectation of politicization as a top barrier this year. Scientists in biopharma are considering the effects of politicization of scientific topics on investor sentiments, specifically as it relates to their access to funding. This cohort may be impacted by potential investor decisions to defund certain sectors or projects in life sciences that are becoming more politicized.

In contrast, scientists remain confident in their ability to collaborate and connect within life sciences. Over three quarters (76%) of our respondents look to peer-reviewed publications for information about their specialization or industry, while the proportion of those selecting “people in my professional network” and “colleagues in my organization” as trusted sources of information have increased significantly since mid-2024.

Further supporting scientists’ distrust in the general public, government officials and mainstream media were each selected by less than 5% of respondents as trusted sources of information about the industry. These results uncover an opportunity for scientific voices to engage with those outside of the scientific community to more effectively communicate the importance of their work.

And our respondents clearly recognize this opportunity; many are calling upon the life science industry to increase communications with the general public, political leaders, and policymakers to combat further politicization of scientific topics. In extending critical conversations in life sciences beyond the industry, our scientists express a determination to address potential deficits in trust and reestablish control over how their work is communicated.

Organizations like the American Chemical Society (ACS), American Association for the Advancement of Science (AAAS), and the National Academies of Science, Engineering, and Medicine have begun to supply the industry with resources to strengthen this audience’s ability to communicate their science to a wide range of audiences. As these kinds of resources become more prevalent, scientific communications may become more incentivized–and accessible.

Overall, even though 24% of our scientists reported feeling fearful about the state of life sciences in 2025, just as many say they feel motivated when they think about their work this year.

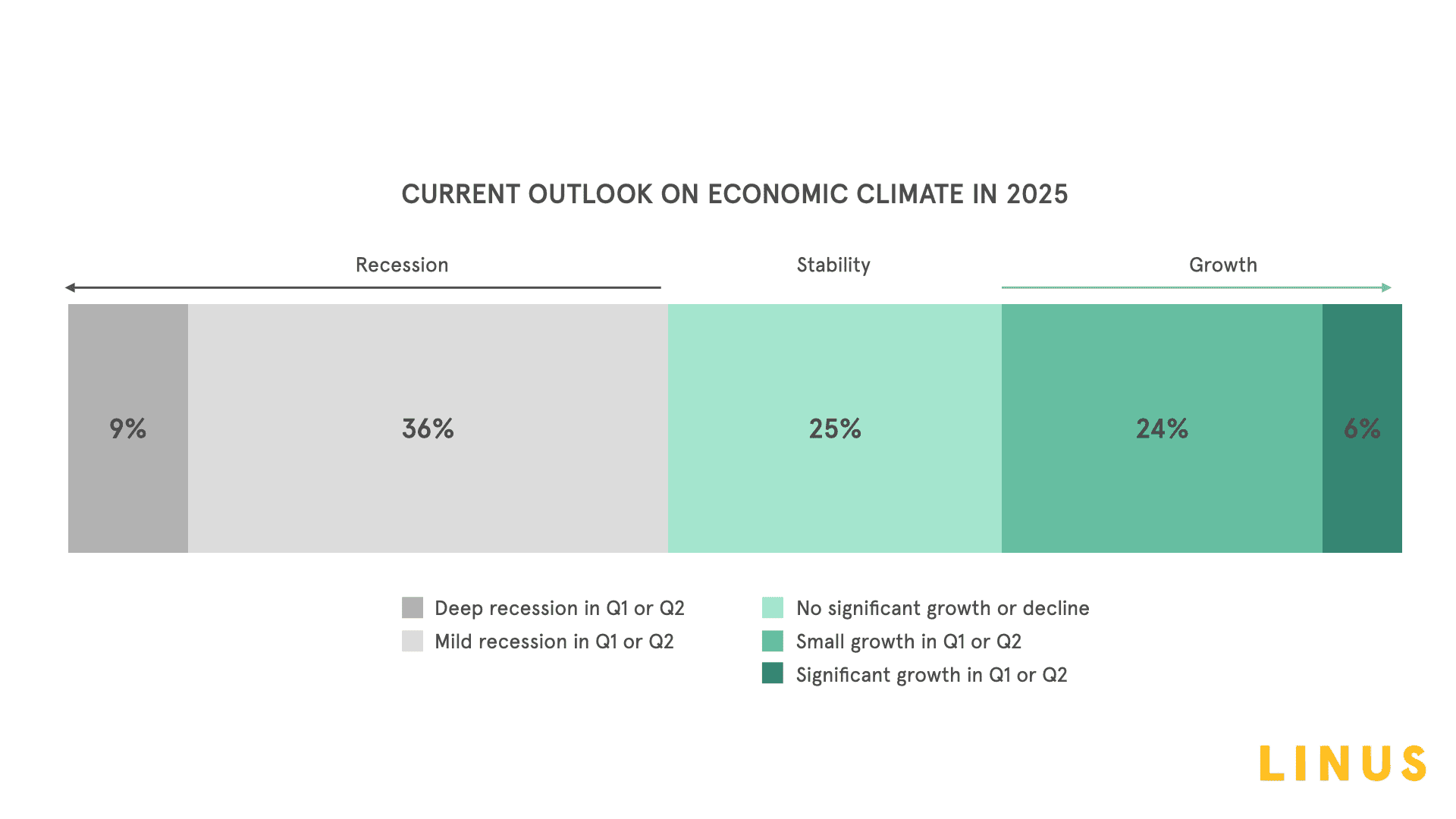

Scientists’ feelings of motivation are also apparent in their economic outlooks. Our respondents’ expectations for the economy mirror January 2024, and biopharma is especially poised to grow in 2025.

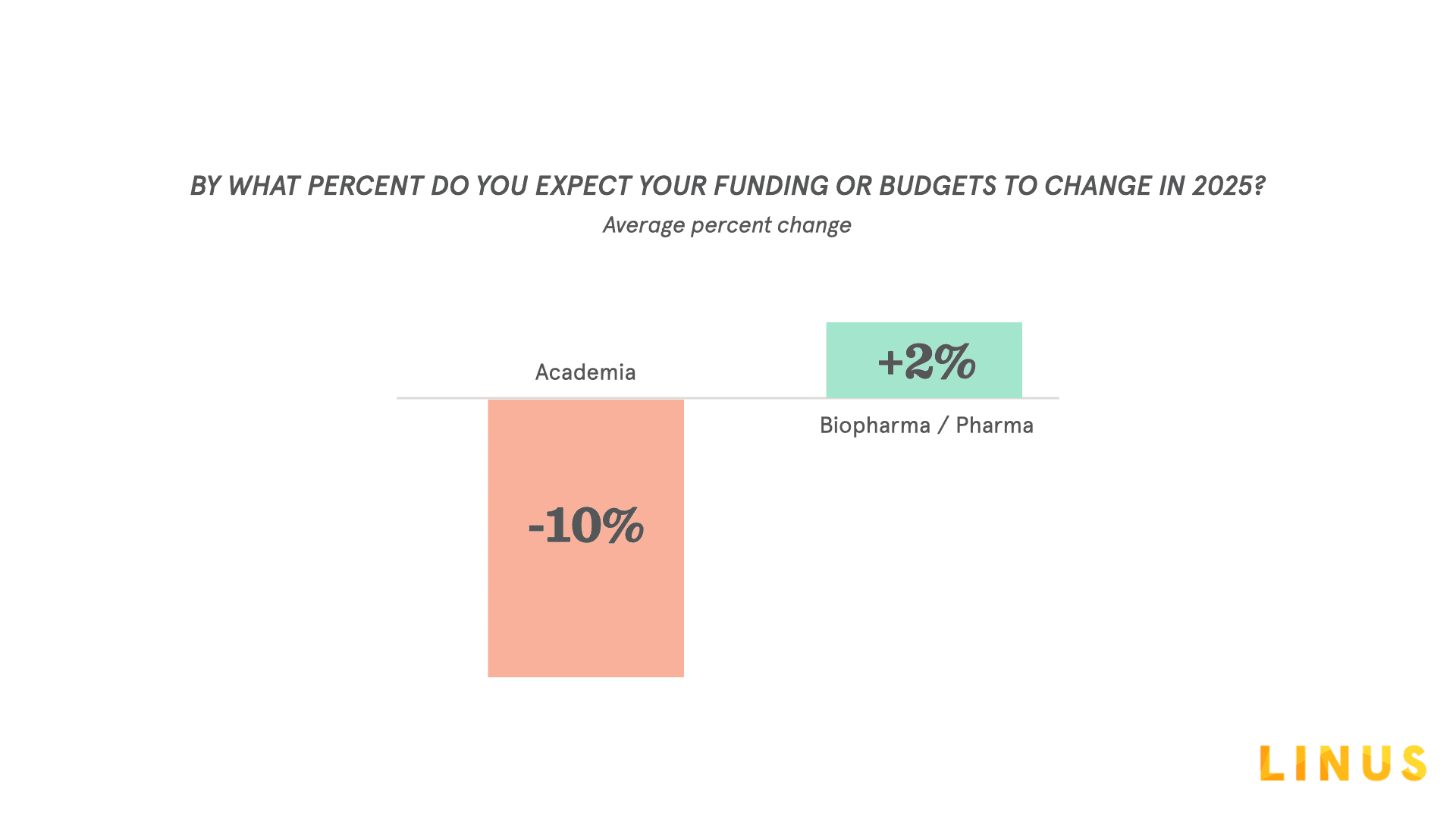

Even before the NIH cap on indirect cost payments was announced, academic scientists were predicting their funding and budgets to decrease by an average of 10% in 2025. Conversely, scientists in biopharma expected their budgets to grow this year.

Although an average increase of 2% may not seem significant, it’s important to note the twelve point difference in average expected budget change between academia and biopharma. Biopharma expects their funding and budgets to grow in 2025, while academia does not.

Academic and biopharma scientists are aligned on their cautiously optimistic expectations about the economy in 2025. Over half (55%) of our respondents predict economic stability or growth this year; the same proportion who predicted stability or growth in January 2024.

Regardless of economic outlook, attracting new funding will be a top priority across life sciences this year. When asked how they plan to prepare for 2025 given their economic outlooks, the proportions of scientists predicting recession, stability, and growth each say their top priority is applying for new sources of funding. Where economic expectations are relatively positive this year, respondents will focus on maintaining their funding–and therefore workload–through 2025.

Purchase intent for everyday lab products like reagents and consumables is another key metric used to gauge scientists’ planned activity level for the coming year. While nearly 80% of our scientists expect the costs of everyday lab products to increase this year, an overwhelming majority (85%) will either maintain or increase purchases of these products in 2025. This data suggests that respondents will look to maintain or increase the level of everyday lab work they perform this year.

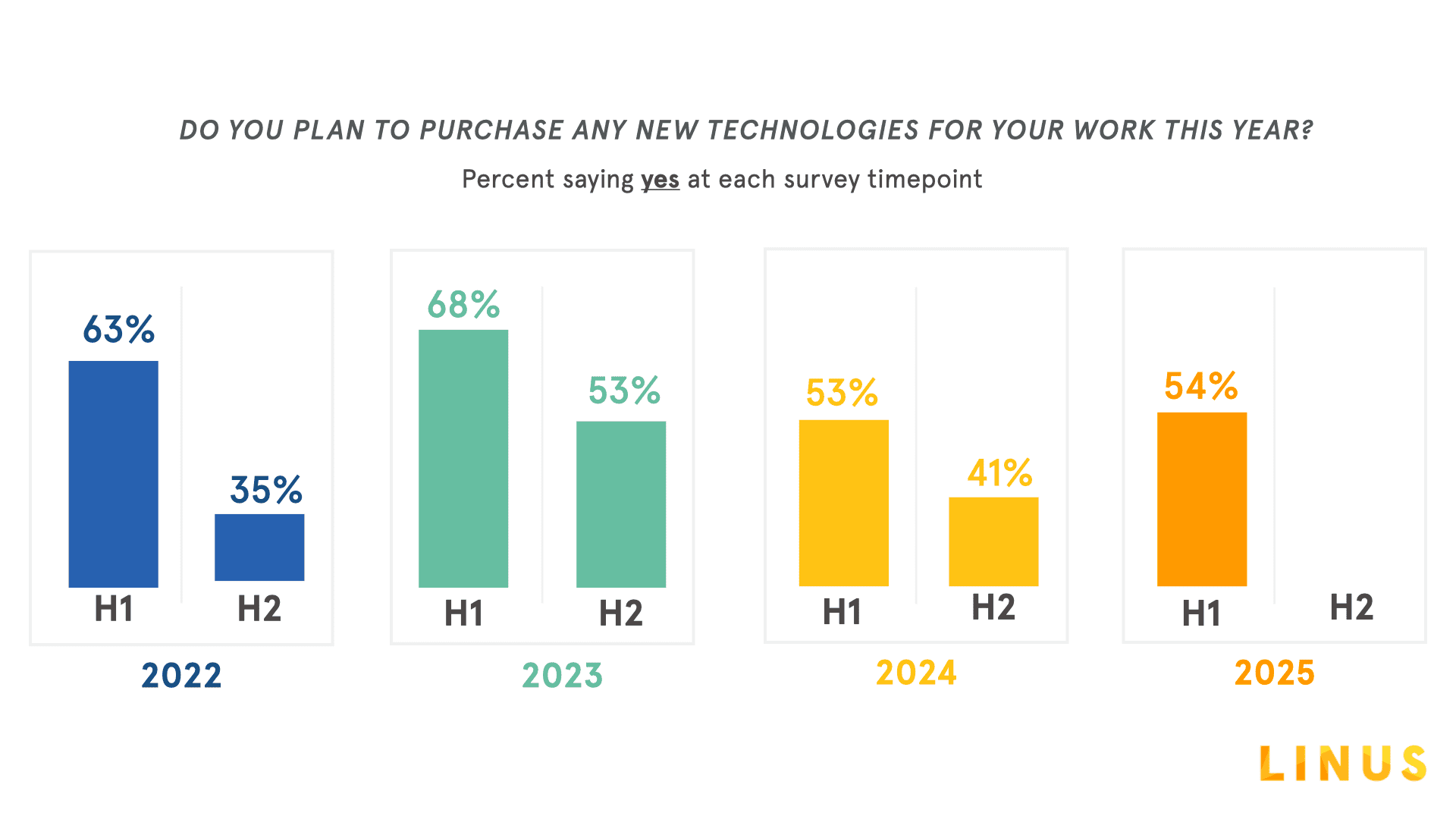

Similarly, purchase intent for new technologies in 2025 resembles what we saw at this time last year. Technology purchase intent has not yet returned to the levels we captured in January of 2022 and 2023, but as of January 2025, over half of our respondents still plan to invest in new technologies this year. Biopharma is especially likely to leverage new purchases to support their trajectory for growth this year, where 60% of this segment plans to buy new technology or instruments in 2025.

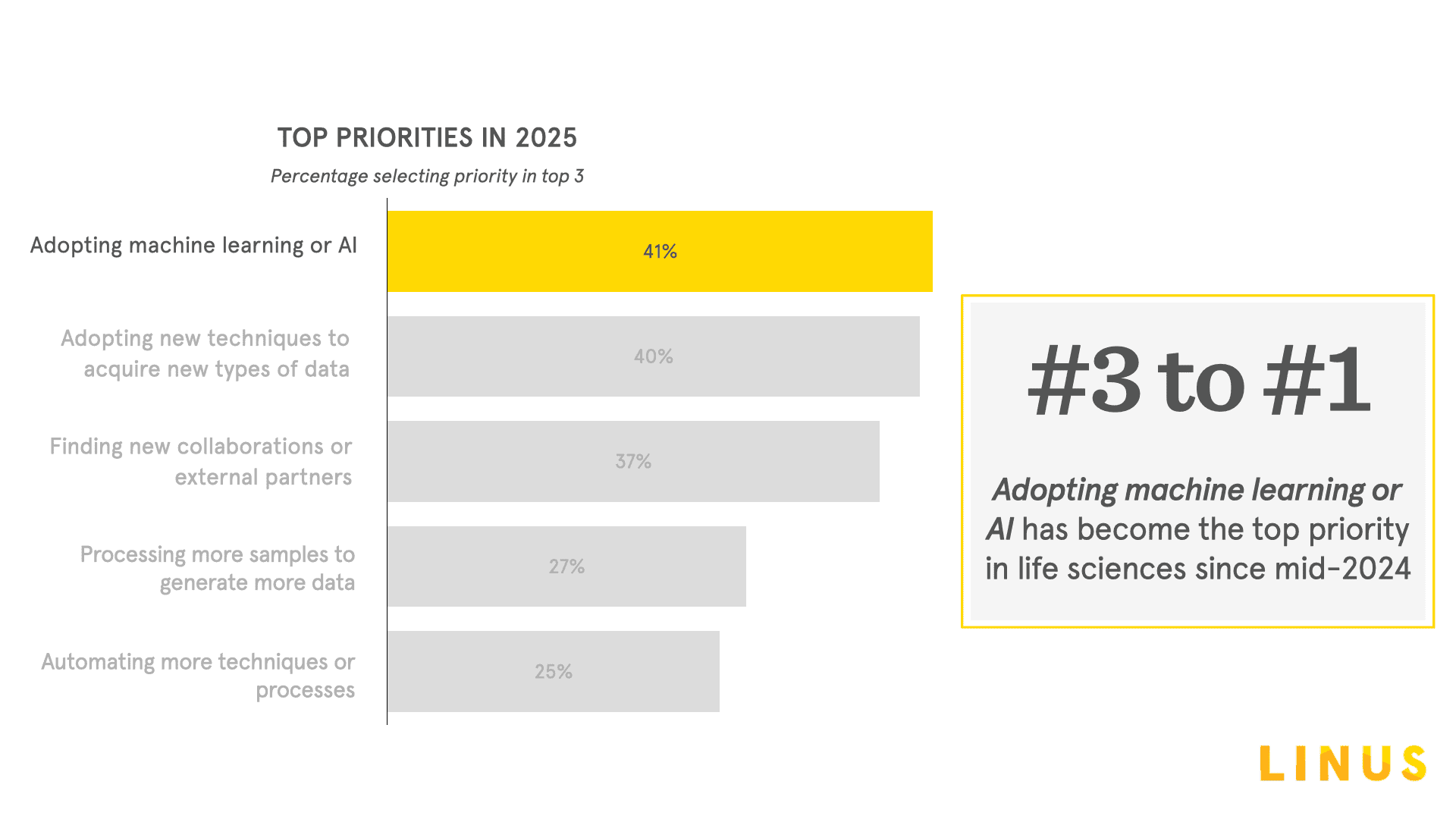

In July 2024, we predicted that leaders in life sciences would be navigating a clear progression from manual workflows to adopting automated technologies that would later allow for more seamless integration of AI and ML tools. We forecasted that by the first half of 2025, we would see investment in AI technologies that would mark the transition from automation to AI integration. Following our respondents’ technology purchase intent from January 2024 to January 2025 signals our entrance into the transition period, where AI has moved from the third-most, to second-most, to now the most-selected technology scientists plan to buy in 2025.

AI and ML will drive impact and innovation in life sciences this year. While each segment will define their productivity differently, scientists in both academia and biopharma will look to AI tools and meaningful industry collaborations to strengthen their work and reach their productivity goals.

Scientists now have concrete plans to invest in AI, and this interest is further confirmed by their predicted sources of impact this year. ML or AI-enabled bioinformatics and ML-enabled predictive modeling remain the top two techniques our respondents expect to make the most significant contributions to life sciences in 2025.

Where adoption of AI and ML was our respondents’ third-highest priority in July 2024, scientists’ top priority in 2025 will be ensuring access to AI and ML tools to enhance their work. Additionally, of those who are prioritizing new collaborations this year, about a third (30%) will seek partners who can empower them to advance their work with AI and ML. This is especially true for biopharma, where 38% of scientists looking for new collaborators will do so for support related to AI and ML. From bench scientists to C-Suite executives, leaders in life sciences will seek opportunities to take full advantage of the potential of AI in 2025.

The industry’s willingness to adopt AI may increase their ability to meet productivity goals this year. While confidence has decreased slightly since January 2024, the majority of our respondents still expect to meet their planned milestones in 2025. When asked whether they are positioned to meet their productivity targets this year, 62% of our scientists expressed high confidence, very high confidence, or certainty that they will achieve their goals.

Confidence in academia is slightly lower than average, where 55% of this segment is highly confident, very highly confident, or certain they will meet their goals. They most often measure their productivity in terms of the number of publications they are able to develop (27%), followed by the number of projects they complete (22%) and the level of funding they receive (15%).

However, a definitive majority of scientists in biopharma expect to meet their productivity milestones; 73% of this segment is highly confident, very highly confident, or certain they will meet their goals. Biopharma defines their productivity in terms of meeting product development or commercialization milestones (36%), the number of projects they complete (30%), and their ability to meet regulatory milestones (13%).

Empowered by AI and new partnerships, scientists across the industry are taking an altogether optimistic view of their ability to make an impact in their field this year.

Would you like to receive the above figures in a slide format? Need specific insights about your particular audience or techniques? We’d be happy to connect — contact us! hello@thelinusgroup.com